On June 12th, President Bola Tinubu officially enacted the Access To Higher Education Bill, commonly referred to as the Student Loan Bill.

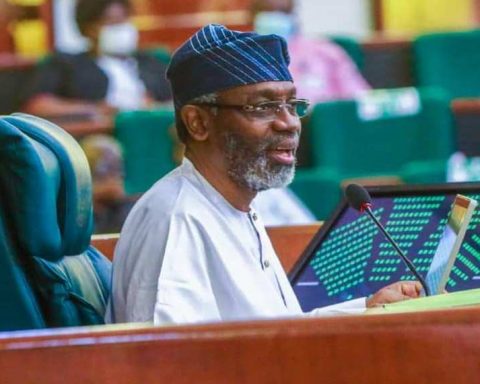

The sponsorship of this bill came from Femi Gbajabiamila, the Speaker of the House of Representatives and Chief of Staff to the President-designate. It had successfully passed through the Legislative in May 2023.

Join our WhatsApp ChannelThe primary objective of this legislation, as indicated in its title, is to facilitate convenient access to higher education for Nigerians.

It achieves this by establishing the Nigerian Education Bank, which offers interest-free loans for educational purposes to Nigerian citizens. The bill serves to provide education opportunities to Nigerians and addresses related matters.

READ ALSO:President Tinubu Signs Student Loan Bill Into Law

Below are 8 key facts you should know about the new law:

All applicants must apply to the Chairman of the Bank and through the Student Affairs Office of their various institutions – University, College of Education, Polytechnic or Vocational School – established by the Federal Government or any State Government.

Applicant income or family income shall be less than N500,000 per annum

Each applicant must provide two guarantors who must be a civil servant with at least 12 years experience, or a lawyer with at least 10 years post-call experience, or a Judicial Officer, or a Justice of Peace

A student can be disqualified if they or their parents have defaulted of any loan in the past, or they (student) have been convicted of drug related offences or any felony involving dishonesty or fraud, or they if the student has been found guilty of exam malpractices by any school authority.

Processing and disbursement of the loan shall be made within 30 days of the application reaching the Bank

The loan granted to students shall be only for the payment of Tuition and shall be interest-free.

Payment of the Loan shall commence two years after the completion of the applicant’s NYSC programme.

10% of the applicant’s salary shall be deducted at source by any employer for the repayment of the loan. And if they are self-employed, they will remit 10% of their total monthly profit as repayment of the loan.

Defaulters, or anyone aiding them shall be liable, upon conviction, to two years imprisonment, or a fine of N500,000 or both.

More information on the Bill can be found here.

Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina

- Somto Bisina