The global scramble for rare earths and other critical minerals is accelerating, and financial advisory giant deVere Group believes it will be one of the defining investment themes of 2026 as the United States and China intensify their fight for control of the materials powering the modern economy.

Join our WhatsApp Channel

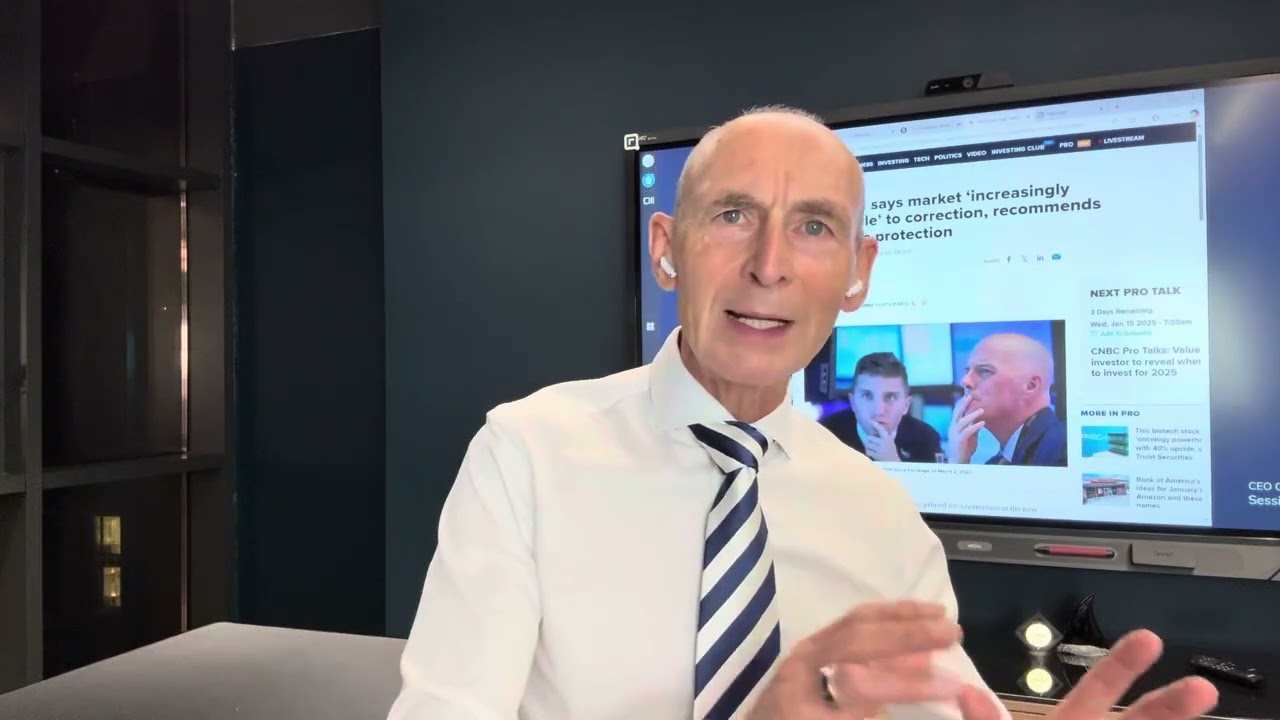

Nigel Green, chief executive of deVere Group, says: “Rare earths have moved from the periphery of the commodities market to the centre of global strategy.

“The battle to secure them will shape trade, technology, and investment decisions for years to come.”

The minerals, which are essential for electric vehicles, smartphones, and advanced weapons systems, have long been dominated by China.

It currently controls around 70% of mining and close to 90% of processing capacity, leaving global manufacturers heavily exposed to Chinese policy decisions.

That dominance is now being challenged. The Trump administration has made rare earths a national priority, pouring money into domestic and allied production.

It has taken stakes in North American miners, proposed a government-backed price floor to stabilise supply, and set out plans to build a strategic mineral reserve. Permitting processes are being fast-tracked, and environmental rules have been eased to accelerate mine construction under the so-called “mine, baby, mine” policy.

Nigel Green says: “Washington’s intervention marks the start of a new industrial cycle.

“The US wants to reclaim control of its supply chains and reduce its vulnerability to Beijing. This is not just policy theatre; it’s the largest coordinated push for resource security in a generation.”

At the same time, China has tightened its own grip. Beijing has imposed new export controls requiring companies to obtain approval before shipping magnets that contain even trace amounts of Chinese-sourced rare earths.

It has also added five more elements, namely holmium, erbium, thulium, europium, and ytterbium, to its restricted list.

READ ALSO:Investors Shrug Off Banking Jitters, But More Volatility Lies Ahead – deVere CEO

“China is showing that control of supply means control of markets,” says deVere’s CEO.

“The US and its allies are now being forced to build alternative supply chains, which is driving an unprecedented wave of investment across Australia, North America, and parts of Africa. The financial markets are following the geopolitics.”

He adds: “The investment implications are significant. This is a multi-year transformation, not a short-term story. The infrastructure and refining capacity cannot be built overnight. Investors positioning early will benefit from the sustained capital flow into strategic resources.”

deVere analysts expect continued volatility in the sector as governments intervene and policy announcements move prices.

Nigel Green says: “These markets will not move on earnings alone. They’ll move on policy. Every export restriction, every government stake, every strategic partnership will have a market impact. This volatility can create opportunity for disciplined investors.”

He continues: “Diversification across the supply chain, from mining to refining to recycling technologies, will be key. This is about securing the systems that keep economies running. Investors who recognise that will be the long-term winners.”

Nigel Green concludes: “Rare earths are at the crossroads of industrial policy, clean energy, and national security.

“The competition to control them will define 2026. The scale of investment already underway shows how quickly the world is recalibrating to a new economic reality. It’s a once-in-a-generation shift in where value is being created.”

Down global soutyh in Africa experts beleieve that the evolving hihj recognition of rare earths and associated minerals would furthwer intensify the economic scramble for influence on Africa’s mining sites. Specifically , an associate profesor of Economics at the University of Nigeria, Nsukka (UNN), Dr Jonathan, while responding to the developement, linked the rising demand for such mninerals to the increase in insecurity and terrorism in Nigeria.

“The minerals they are stealing from Northgeast Nigeria is the reason politicians are funding terrorism in Nigeria,” Dr Jonathan told Prime Business Africa on Tuesday.

- Editor

- Editor

- Editor

- Editor

- Editor