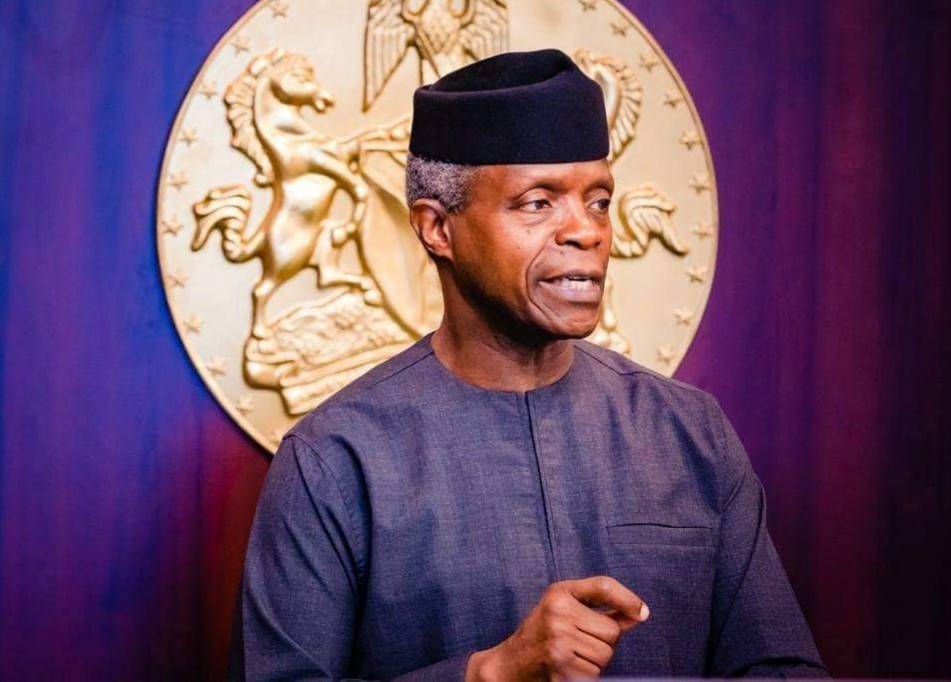

THE Vice President, Prof. Yemi Osinbajo, says the Presidential Enabling Business Environment Council (PEBEC) will address the problem of multiple taxation on businesses.

Osinbajo disclosed this at the First Abuja Small and Medium Enterprises (SMEs) Conference and Exhibition 2021.

Join our WhatsApp ChannelThe VP, who was represented by Minister of State for Industry, Trade and Investment, Mariam Katagun, said government was focused on improving ease of doing business and encouraging tax and fiscal responsibility.

The Vice President noted that the problem of taxation on the growth of SMEs in the country had been aggravated by lack of reliable data for statistical analysis.

According to him, the mortality rates of SMEs are very high, and among the factors responsible for this are tax related issues.

He said it was on the above premise that the government, through the Finance Act 2019 and 2020, amended various tax and fiscal legislations to align Nigerian business environment with global standards.

The VP said, “One of such amendments is the categorisation of companies into small, medium, and large companies, based on annual gross turnover as seen in the Finance Act 2019. The Act also has, as one of its strategic objectives, support to small businesses, in line with the Ease of Doing Business reforms.

“However, some of the specific challenges related to taxation are multiple taxation at the national and sub-national levels, non-clarity on the procedure and amount to pay and non-friendly tax administrators.”

Osinbajo said for SMEs to sustain their role of contributing to the mainstream economy, they must implement effective strategies in their business operations, inclusive of logistics.

The Vice President noted some challenges related to logistics as high transportation costs, lack of quality delivery service and infrastructure, addinging that the challenges related to packaging were non-availability of quality materials, high cost of materials and lack of inbuilt culture of packaging.

He said to resolve some of these challenges, specific actions must be put in place to overcome them.

These, according to him, include sensitisation and awareness creation, general capacity building and streamlining of taxes across the national and sub-national levels.

He listed others as implementation of relevant sections of the Finance Acts, specific technical training on packaging and logistics, sharing of knowledge and peer review with SMEs in other jurisdictions.

He also called for strict observance of international standards, adding that regulatory authorities must develop friendly criteria for SMEs.

According to Osinbajo the conference was apt, in view of the African Continental Free Trade Area (AfCFTA), because several African countries have the scale to compete with Nigerian businesses in terms of productive capacity, packaging, exports and logistics.

He said SMEs should adapt to the competition created by AfCFTA and position themselves to take advantage of the single market of 1.2 billion people and a cumulative GDP of over $3.4 trillion.

Osinbajo appreciated contributions of MSMEs to Nigeria’s economy, widely reported to have recorded over 41 million participating enterprises, accounting for about 76 per cent of the nation’s labour force and 50% Gross Domestic Product (GDP).

He said it was against this backdrop that the Federal Government reinvigorated its commitment and interest in repositioning and investing in the sector for efficiency, growth and development.

The conference, which was organised by the Abuja Chamber of Commerce and Industry (ACCI), was aimed at providing solution strategies for resolving tax, regulatory, packaging and logistic challenges facing Nigerian SMEs.

Follow Us