The US Government shutdown will extend into next week as the Senate adjourns without breaking stalemate, but investors appear strangely unfazed.

Join our WhatsApp Channel

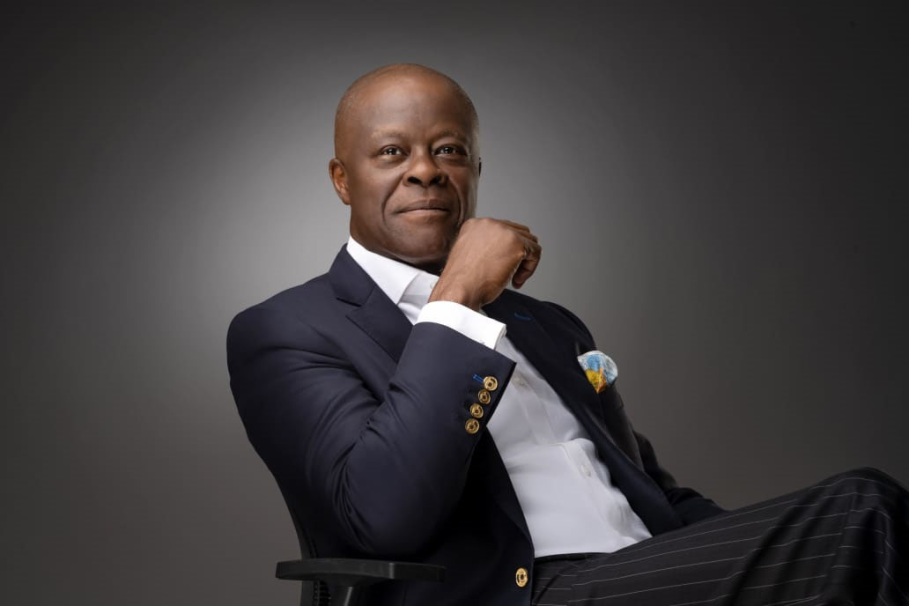

Their calm may prove dangerously misplaced, warns Nigel Green, CEO of global financial advisory giant deVere Group, as markets are underestimating the escalating risks posed by the country’s ballooning national debt.

“The market’s indifference to the shutdown reflects a broader and more troubling complacency about the United States’ fiscal position,” he says.

“Investors are treating the gridlock as political noise when, in reality, it’s a warning signal about a system buckling under unsustainable debt.”

With Washington paralysed and the deficit climbing, America’s fiscal foundations are showing serious cracks.

The government ran a $1.8 trillion deficit last fiscal year — nearly double its pre-pandemic average — and the national debt has surged past $37.9 trillion, according to official Treasury data.

“Interest payments on that debt are projected to exceed national defence spending within the next few years.Yet investors continue to act as though record equity highs and easy liquidity make the debt irrelevant. They don’t. “Every shutdown, every stalemate, every borrowing debate highlights that the US is living beyond its means,” Nigel Green notes.

“This level of indebtedness carries long-term consequences for growth, stability, and confidence in the dollar itself.”

Despite a weakening labour market, sticky inflation, and warnings from credit agencies, Wall Street continues to trade near record levels. The S&P 500 and Nasdaq have repeatedly hit new highs this year, even as bond yields creep up and fiscal conditions deteriorate. “The assumption from many investors is that the government will always find a way to borrow more, spend more, and avoid default. That assumption is being tested,” says the deVere Group CEO.

“Borrowing costs are rising, and global demand for US debt cannot be taken for granted.mAt some point, the sheer size of the interest burden begins to crowd out productive investment and strain public finances.

“Investors who ignore that structural shift do so at their peril.”

The market’s insensitivity is rooted in habit — a decade of low rates and central bank support has taught investors to look past fiscal risks.

However, conditions have changed. With higher rates now entrenched and political consensus fractured, the cost of debt servicing has exploded. The Treasury is paying more than $1 trillion annually in interest, and that figure is still climbing.

“Debt is now the defining economic issue of this decade,” Nigel Green continues.

“It affects everything from bond market liquidity to the credibility of US fiscal policy. Investors should be demanding sustainable reform, not assuming it will appear by default.”

The political stalemate reinforces the perception that Washington has lost the ability to make hard fiscal decisions. Proposals to curb spending or raise revenues are routinely blocked, while populist promises continue to expand future liabilities. This dynamic is deeply corrosive for confidence, both domestically and abroad.

“The failure to address the debt problem undermines the very thing investors rely on most: trust,” says Nigel Green.

“You can’t have sustained economic leadership when your balance sheet is this distorted. Sooner or later, the market will start to price that reality in.”

While equities remain buoyant, cracks are appearing beneath the surface. Treasury auctions are showing weaker demand, foreign holdings of US debt have declined, and credit markets are beginning to reflect higher long-term risk premiums.

The world’s largest economy can absorb a great deal, but not indefinitely.

“Markets are behaving as if the US can borrow forever without consequence,” Nigel Green concludes.

“That illusion will end abruptly. When it does, investors who ignored the debt dynamic will find themselves badly exposed.”

- Editor

- Editor

- Editor

- Editor

- Editor