Standard Chartered Bank (Nigeria) has launched a sophisticated Wealth offering that gives clients access to additional liquidity to meet their investment needs within the bank.

Tagged ‘Leverage Lending’, the offer is a variant of the bank’s wealth management lending solution which allows clients to access funds by borrowing money to invest in approved securities in addition to their contribution.

Join our WhatsApp ChannelClients would potentially benefit from higher returns on the investment product using this leverage financing method. Leverage Lending offers clients more liquidity to Invest in Mutual Funds, FGN Bonds, Euro Bonds and Treasury Bills, solving a need for clients to grow their investment portfolio.

Some of the features of the Leverage Lending product include attractive lending rates, repayment flexibility and potential to achieve higher returns on investment.

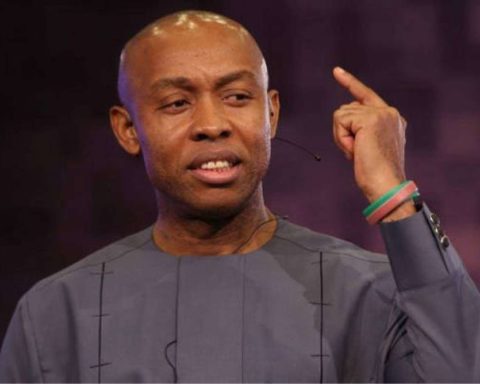

Speaking on the offering, Simpa Adaba, Head of Wealth Management said, “At Standard Chartered Bank, our purpose is to drive commerce and prosperity through our unique diversity. Hence, we are constantly seeking ways to help clients prosper and grow their wealth. This product is one way we can achieve this by providing a platform for clients to attain their investment goals without being constrained by access to liquidity.”

According to Adaba, the Leverage Lending offer is currently available to the bank’s priority banking clients.

- Editor

- Editor

- Editor

- Editor

- Editor