Ghana has raised GH¢9.081bn in its first Treasury bill auction of the year, exceeding its initial borrowing target and signalling strong investor appetite for short-term government debt.

The auction, held on 8 January, received bids totalling GH¢9.1bn for 91-day, 182-day and 364-day Treasury bills. The government had initially planned to borrow GH¢7.564bn, meaning the offer was oversubscribed by about 20%.

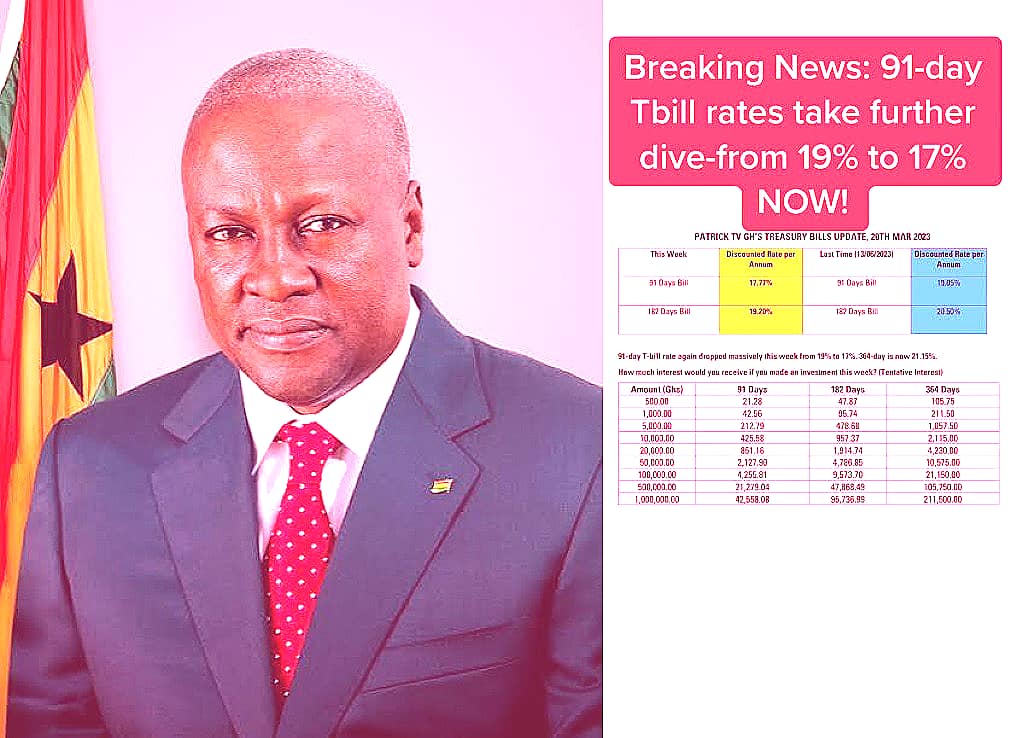

Most of the funds came from the 91-day bill, which attracted GH¢6.535bn, reflecting investors’ preference for shorter-term instruments. The 364-day bill brought in GH¢1.491bn, while the 182-day bill raised GH¢1.055bn. Weighted average interest rates were 11.1% for the 91-day bill, 12.6% for the 182-day bill and 12.98% for the 364-day bill. The government has set a lower borrowing target of GH¢7.149bn for its next auction, scheduled for 15 January.

Join our WhatsApp ChannelREAD ALSO: Ghana Begins IMF Programme Exit as Economic Recovery Gains Momentum

This is not the first time Ghana has received more money than its initial target. Oversubscriptions have been recorded in 2025 and late 2024, with some auctions exceeding their targets by 14% to 24%. In mid-2025, investors submitted GH¢20.49bn in bids for a GH¢7.72bn target, although the government accepted less than the total offers. Some auctions, however, fell short of their targets, such as one in August 2025, which missed by 22%.

Prime Business Africa analysis showed that what makes the January 2026 auction notable is its timing and consistency. It kicked off the fiscal year with strong demand, forming part of a series of consecutively oversubscribed auctions, suggesting a sustained trend rather than a one-off event. The 20% oversubscription demonstrates renewed investor confidence and strong liquidity in the domestic market, reinforcing interest in short-term government securities.

Despite recent borrowings, Ghana has also recorded a steady decline in inflation, falling from 23.8% in December 2024 to 5.4% in December 2025. Analysts say this reflects prudent economic management, suggesting that government policies have helped stabilise prices and strengthen investor confidence.

- Editor

- Editor

- Editor

- Editor

- Editor