The Nigeria Incentive-Based Risk Sharing System for Agricultural Lending (NIRSAL Plc) has announced a remarkable rebound in its operations, which has resulted in the facilitation of over ₦70 billion in commercial financing for agribusiness as at Q3 2025, its strongest annual performance since inception.

In operation since 2013, this result represents nearly a quarter of the organisation’s cumulative ₦270 billion facilitated for agriculture and agribusiness to date, an achievement that underscores the impact of NIRSAL’s revamped strategy under its new Board and Executive Management.

Join our WhatsApp ChannelREAD ALSO: NIRSAL Microfinance Bank Debunks Shutting Out 100,000 Loan Applicants In Anambra

Climate Change Chaos: Africa Emits Less But Suffers More

The timing of this turnaround is critical: Bank lending to agriculture had been in steady decline, falling from 6.18% of aggregate lending in 2022 to 4.82% in 2024, while sectoral growth slowed from 2.5% to 1.7% within the same period. By applying its signature tools for value chain modelling to address identified issues, providing technical support to agribusinesses and financial institutions, all while deploying its risk-sharing frameworks, NIRSAL has restored lender confidence thus channelling fresh funds into key value chains, including grains, cocoa, shea, and livestock.

In terms of impact, there has been an improvement in local production across key commodities and a positive balance of trade for agriculture, with over 32% of the facilitated sum directly supporting value-added commodity export. Most notably, agriculture’s share of bank lending has risen again to 5.33% as of May 2025, reflecting renewed interest from financiers. Two newly licensed banks have also entered the sector relying on NIRSAL’s frameworks, contributing to the ₦70 billion facilitated so far this year.

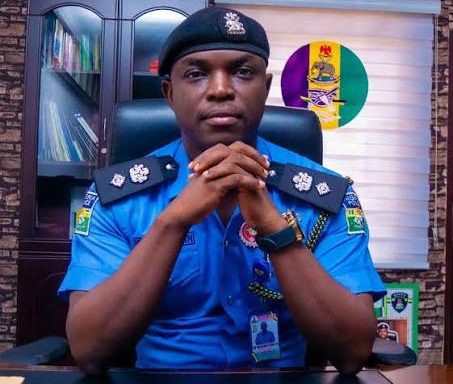

Commenting on the milestone, NIRSAL’s Managing Director/CEO, Sa’ad Hamidu, said: “₦70 billion may appear modest compared to the size of Nigeria’s agricultural financing needs, but the significance is profound. It proves that agriculture can be commercially and sustainably financed. With the right blend of capital, technical support, and risk mitigation, the sector can become more productive, resilient, and globally competitive.”

Hamidu added that NIRSAL remains confident of hitting its ₦150 billion target for 2025: “This is not yet the peak of the harvest season when merchants typically seek credit for offtake and storage, and when super agro-dealers stock up on fertilisers and inputs ahead of the next planting cycle. Therefore, the opportunities still to come give us every reason for optimism.”

Beyond headline figures, NIRSAL is working to reshape the lending landscape for agriculture. Its integrated model, spanning prospect identification, deal structuring, business advisory, and credit guarantees, handholds agribusinesses from loan origination to disbursement. Also, by providing tailored advisory and risk mitigation, the institution helps businesses once deemed unbankable to gain access to sustainable credit.

Through this approach NIRSAL aid the creation of a pipeline of emerging agribusinesses while supporting established firms to scale. Meanwhile, several borrowers who once engaged NIRSAL have since graduated into routine lending relationships with their bankers whose understanding of the dynamics of agribusiness has grown, leading to greater comfort in lending. This proves that the NIRSAL model is a pathway to long-term sustainability in the agriculture sector.

The ₦70 billion facilitated so far this year is a direct outcome of NIRSAL’s sustained capacity-building efforts for financial institutions. Through targeted training sessions for over 1,100 staff of banks, NIRSAL has deepened understanding of agricultural financing within its risk-sharing framework leading to an increase in loan request approvals. Similar training programs for agricultural value chain actors, including 450 participants trained on feedlot management, commodity export, and climate finance so far, will become increasingly evident over time, as capacity and confidence grow across these sub-sectors.

As part of its forward agenda, NIRSAL is developing a digital network it calls the NIRSAL LandBank portal—a connected ecosystem of agricultural stakeholders, from research and development to markets, to provide data-driven insights for investors, policy makers, and development partners for the identification of opportunities, risk reduction, and informed decision-making.

The LandBank portal would become an additional channel for project development, with climate finance another potential source of funding. NIRSAL continues to deepen its interest in and collaboration around climate finance, recently signing an understanding with the Rural Electrification Agency to provide off-grid power to production and processing clusters in rural locations. These efforts, the institution believes, will build resilience into the agricultural value chain and aid Nigeria’s push toward a $1 trillion economy.

Since its establishment, NIRSAL has remained faithful to its mandate of de-risking agricultural lending, facilitating finance across the value chain, and proving that agriculture is both bankable and sustainable. Its 2025 performance to date signals not just recovery, but a new era of confidence for Nigeria’s farmers, financiers, and the wider economy.

- Editor

- Editor

- Editor

- Editor

- Editor