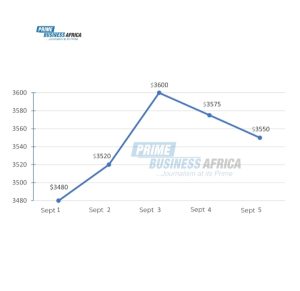

Gold extended its rally last week, surging to fresh record highs before consolidating near $3,550 per ounce. The metal gained on the back of mounting expectations for a Federal Reserve rate cut, heightened political uncertainty in Washington, and a global bond market rout that underscored broader concerns over economic and financial stability.

Join our WhatsApp ChannelWeekly Performance

- Monday, Sept 1: Gold extended its rebound, climbing nearly 1% to trade above $3,480 per ounce for the first time since April, buoyed by growing conviction in a September Fed rate cut and political uncertainty.

- Tuesday, Sept 2: Prices held close to record territory as markets priced a 90% chance of a rate reduction, supported by dovish Fed commentary and geopolitical tensions.

- Wednesday, Sept 3: The rally accelerated with fresh record highs, fueled by weaker U.S. manufacturing data, lower real yields, and sustained central bank demand.

- Thursday, Sept 4: Gold surged past $3,575 per ounce, its strongest level in history, as global investors accelerated their flight to safety amid bond market turmoil and political risks.

- Friday, Sept 5: The metal consolidated near $3,550 per ounce, steady just below its highs, as investors weighed the global bond selloff, sticky inflation, and intensifying pressure on Fed independence.

Gold ended the week with a net gain of roughly 2%, closing just shy of its record peak.

Drivers of the Rally

Fed Policy Outlook Speculation over imminent U.S. monetary easing remained the central theme. A shift in tone from Federal Reserve Chair Jerome Powell after Jackson Hole, combined with dovish remarks from San Francisco Fed President Mary Daly, fueled bets that a rate cut could arrive as soon as September. Markets are now pricing in a nearly 90% chance of a 25-basis-point reduction.

Political Pressure on the Fed President Trump’s dismissal of Governor Lisa Cook and push for new board nominees unsettled markets, raising questions over the Fed’s independence. Analysts told Prime Business Africa that the politicization of monetary policy could destabilize global markets, amplifying gold’s appeal.

Geopolitical Tensions Meetings between North Korea’s Kim Jong Un, China’s Xi Jinping, and Russia’s Vladimir Putin raised fears of deeper military cooperation. Meanwhile, instability in the Middle East and Trump’s erratic trade stance reinforced safe-haven demand.

READ ALSO: Discover the Gold Trading Guide from JustMarkets

EFCC Under Scrutiny As Operatives Disappear With Seized Gold, $30,000

Bond Market Stress A sharp global selloff in long-dated government bonds was another key catalyst. U.S. 30-year Treasury yields hovered near 5%, their highest levels since July, while Japanese and U.K. bonds hit multi-decade highs. Despite surging yields normally a headwind for gold. Analysts told Prime Business Africa that investors continue to favor bullion as structural fiscal deficits, sticky inflation, and political risks overshadow traditional safe assets.

Central Bank and Investor Demand The People’s Bank of China extended its bullion buying streak to 22 months, while Middle Eastern and Asian sovereigns accelerated their reserve diversification away from the U.S. dollar. ETFs also recorded inflows, and retail demand remained strong, particularly in Asia. Supply constraints, from stagnant mine output to rising environmental costs, added further upward pressure on prices.

Outlook

Gold’s performance from September 1 to 5 underscores a paradox: even as global yields rise, demand for non-yielding metals remains robust. Analysts told Prime Business Africa they expect the metal to maintain its upward trajectory, though profit-taking and technical pullbacks are likely.

The coming week will bring critical U.S. economic data, including consumer price inflation and retail sales, which could shape expectations ahead of the Fed’s September policy meeting. With political pressure mounting, bond markets wobbling, and central banks accelerating diversification, the bullish case for gold remains intact.

Amanze Chinonye is a Staff Correspondent at Prime Business Africa, a rising star in the literary world, weaving captivating stories that transport readers to the vibrant landscapes of Nigeria and the rest of Africa. With a unique voice that blends with the newspaper's tradition and style, Chinonye's writing is a masterful exploration of the human condition, delving into themes of identity, culture, and social justice. Through her words, Chinonye paints vivid portraits of everyday African life, from the bustling markets of Nigeria's Lagos to the quiet villages of South Africa's countryside . With a keen eye for detail and a deep understanding of the complexities of Nigerian society, Chinonye's writing is both a testament to the country's rich cultural heritage and a powerful call to action for a brighter future. As a writer, Chinonye is a true storyteller, using her dexterity to educate, inspire, and uplift readers around the world.