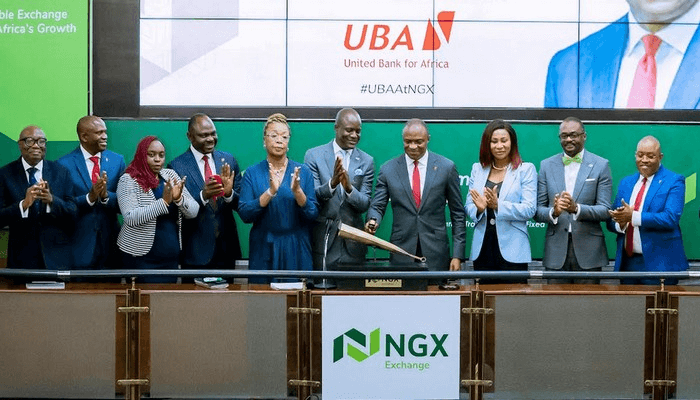

The Nigerian Exchange Limited (NGX) has formally admitted an additional 3.156 billion ordinary shares of United Bank for Africa (UBA) Plc to its Daily Official List, a move expected to deepen market liquidity and significantly enhance the bank’s market capitalisation, Prime Business Africa reports.

The listing followed the successful conclusion of UBA’s recent rights issue and was confirmed in a letter dated January 12, 2026, signed by the Head of the Issuer Regulation Department at NGX, Godstime Iwenkehai.

According to the exchange, the newly listed shares arose from UBA’s rights issue of 3,156,869,665 ordinary shares of 50 kobo each, priced at N50.00 per share, on the basis of one new ordinary share for every 13 ordinary shares held by shareholders as at the close of business on July 16, 2025.

Join our WhatsApp Channel“Following the submission of all post-approval documents, please be informed that United Bank for Africa Plc’s Rights Issue of 3,156,869,665 ordinary shares of 50 Kobo each at N50.00 per share… were formally listed on the Daily Official List of Nigerian Exchange Limited (NGX) today, Monday, 12 January 2026,” Iwenkehai stated.

READ ALSO : Tantalizer Among Gainers As NGX Market Cap Surges By N598bn

NGX Traders Exchange N33.54bn Shares, Market Cap Hits N106trn

With the admission of the additional shares, UBA’s total outstanding shares listed on the NGX have increased from 41,039,305,642 to 44,196,175,307 ordinary shares, further strengthening the bank’s presence on the equities market.

Reacting to the development, UBA’s Group Managing Director and Chief Executive Officer, Oliver Alawuba, described the listing as a strong validation of investor confidence in the bank’s strategy and long-term outlook.

“We welcome the formal confirmation from NGX on the listing of our rights issue shares. This successful transaction reflects strong investor confidence in UBA’s financial strength, governance, and growth strategy,” Alawuba said.

“The additional capital will further support our Pan-African and global expansion and enhance our capacity to deliver sustainable value to all stakeholders.”

The rights issue represents the latest phase of UBA’s capital-raising efforts. In November 2024, the bank raised N239 billion, increasing its capital base to N355 billion at the time. The recently concluded rights issue injected an additional N158 billion, bringing UBA’s total capital to about N513 billion.

This capital level places the bank above the N500 billion minimum capital requirement set by the Central Bank of Nigeria (CBN) for banks with international authorisation, effectively positioning UBA ahead of the regulatory recapitalisation threshold.

UBA remains one of Africa’s largest financial institutions by footprint, employing about 25,000 staff across its operations and serving over 45 million customers worldwide.

The bank operates in 20 African countries, as well as in the United Kingdom, the United States, France and the United Arab Emirates, offering retail, commercial and institutional banking services, with a focus on financial inclusion and technology-driven solutions.

Market analysts say the additional listing is likely to improve trading depth in UBA shares, enhance investor participation, and reinforce the bank’s standing among Nigeria’s most capitalised listed financial institutions.

Amanze Chinonye is a Staff Correspondent at Prime Business Africa, a rising star in the literary world, weaving captivating stories that transport readers to the vibrant landscapes of Nigeria and the rest of Africa. With a unique voice that blends with the newspaper's tradition and style, Chinonye's writing is a masterful exploration of the human condition, delving into themes of identity, culture, and social justice. Through her words, Chinonye paints vivid portraits of everyday African life, from the bustling markets of Nigeria's Lagos to the quiet villages of South Africa's countryside . With a keen eye for detail and a deep understanding of the complexities of Nigerian society, Chinonye's writing is both a testament to the country's rich cultural heritage and a powerful call to action for a brighter future. As a writer, Chinonye is a true storyteller, using her dexterity to educate, inspire, and uplift readers around the world.

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye