First Bank of Nigeria has officially met the ₦500 billion minimum capital requirement set by the Central Bank of Nigeria (CBN) for commercial banks with international licences, the bank’s parent company, First HoldCo Plc, announced on Friday.

The achievement comes ahead of the March 2026 deadline mandated under the CBN’s sector-wide recapitalisation directive first issued in March 2024.

Under the directive, commercial banks with international licences were required to hold ₦500 billion, while national and regional banks were set at ₦200 billion and ₦50 billion, respectively. According to the CBN, 27 banks have raised their capital, with 16 already meeting or exceeding the new thresholds.

Join our WhatsApp ChannelREAD ALSO : Nigeria’s Tier-2 Banks Brace for CBN Recapitalisation Shake-Up

Economy, CBN and Capital Inflows

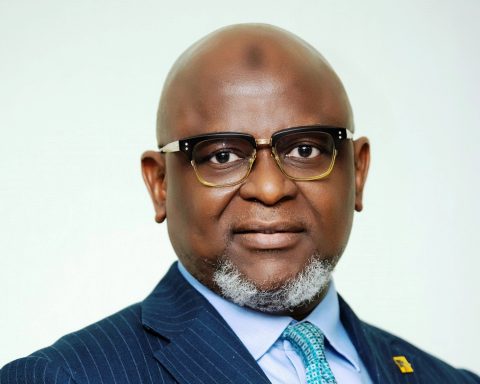

Femi Otedola, Chairman of First HoldCo, described the milestone as a key step in strengthening Nigeria’s banking sector, noting that the group remains committed to further capital injections into subsidiaries and new business ventures.

Otedola praised President Bola Tinubu for his “deep understanding of the Nigerian economy”, highlighting policies that have bolstered macroeconomic stability. He also commended CBN Governor Yemi Cardoso, noting that disciplined monetary reforms have helped curb inflation, strengthen the naira, and lift foreign reserves to a seven-year high above $46 billion.

“The leadership shown by President Tinubu and Governor Cardoso has created the right environment for growth and investor confidence,” Otedola said.

While welcoming FirstBank’s compliance, Otedola urged regulators to increase the minimum capital requirement for international banks to ₦1 trillion, arguing that stronger capital buffers would improve governance, expand ownership structures, and enhance resilience against economic shocks.

He also highlighted the success of other major banks, including Zenith, Access, GTBank, and UBA, in meeting the recapitalisation targets, saying it signals positive momentum across Nigeria’s financial sector.

The CBN’s recapitalisation drive, the first in nearly 20 years, is designed to fortify banks against economic shocks, expand lending to the real economy, and strengthen financial governance.

Otedola described the exercise as timely and necessary, positioning Nigerian banks for long-term growth while enhancing investor confidence in the sector.

Amanze Chinonye is a Staff Correspondent at Prime Business Africa, a rising star in the literary world, weaving captivating stories that transport readers to the vibrant landscapes of Nigeria and the rest of Africa. With a unique voice that blends with the newspaper's tradition and style, Chinonye's writing is a masterful exploration of the human condition, delving into themes of identity, culture, and social justice. Through her words, Chinonye paints vivid portraits of everyday African life, from the bustling markets of Nigeria's Lagos to the quiet villages of South Africa's countryside . With a keen eye for detail and a deep understanding of the complexities of Nigerian society, Chinonye's writing is both a testament to the country's rich cultural heritage and a powerful call to action for a brighter future. As a writer, Chinonye is a true storyteller, using her dexterity to educate, inspire, and uplift readers around the world.

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye

- Amanze Chinonye