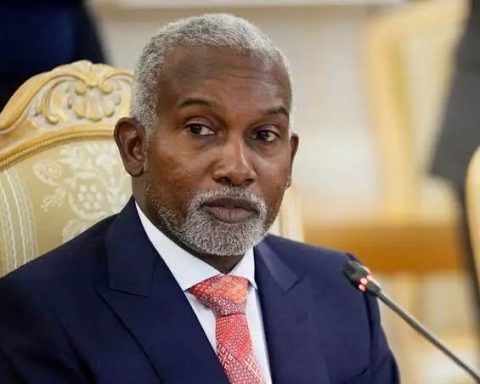

Tanzania’s Minister of Finance and Planning, Mwigulu Nchemba, has announced that all is set to begin imposing a 2% digital tax on global tech giants offering services in the East African country.

According to local media reports, the taxation will take effect from next month, following anticipated approval from the Tanzanian parliament. Reports say that lawmakers are already scheduled to vote on the matter any moment from now.

Join our WhatsApp Channel“Tanzania Revenue Authority shall establish a simplified registration process to accommodate digital economy operators who have no presence in Tanzania. This measure is intended to keep pace with rapid growth in the digital economy,” the Finance Minister was quoted to have said.

With this latest development, Tanzania joins a growing list of African countries that have so far introduced various forms of digital taxation aimed specifically at big global tech companies that make money across Africa. Just last week, a Nigerian regulatory agency announced a code of conduct that would, among other things, require such companies to pay taxes.

The federal government of Nigeria through The National Information Technology Development Agency (NITDA) had released a new code of conduct that regulates the operations of social media platforms in Nigeria.

In a document shared on Twitter titled; CODE OF PRACTICE FOR INTERACTIVE COMPUTER SERVICE PLATFORMS/ INTERNET INTERMEDIARIES, the agency said the information technology systems have become a critical infrastructure in our society that must be safeguarded, regulated, and protected against online harm.

While there is no date for when the code of conduct will take effect, the agency left out rather important parts of the code in its Twitter post. Parts which could threaten neutrality of platforms operations and eventual separation from government and its influences.

PRIME BUSINESS AFRICA Recalls that late last year, about 130 countries reached an agreement to address the global tax challenges that have risen, following the digitisation of the global economy. Championed by the Organisation for Economic Co-operation and Development (OECD), the agreement aims to, among other things, reform the global tax rules in such a way that gives countries more right to impose taxes on multinational digital corporations like Facebook and Google.

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze

- Queen Nwabueze