The United Bank for Africa (UBA) Group has announced plans to embark on further strategic expansion into key markets across Africa.

This was revealed during the UBA Group’s Half-Year Business Review held at its global headquarters in Lagos, Nigeria.

Join our WhatsApp ChannelThe meeting brought together senior executives responsible for UBA Group’s operations in twenty-four countries of presence.

A statement by the banking group said the meeting was an opportunity to restate the company’s pan-African strategy, and commitment to further expanding the Group’s coverage of high-potential markets across Africa, while also deepening its operations in its existing twenty African presence markets.

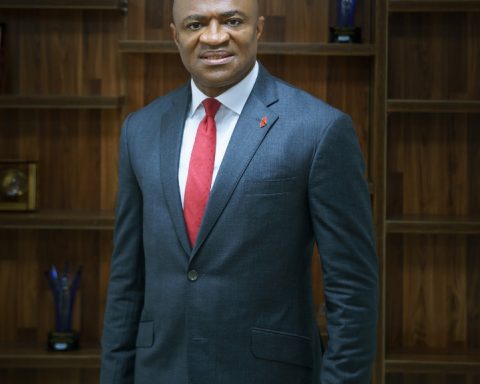

Speaking during the meeting, UBA Group Managing Director/CEO, Oliver Alawuba, highlighted the Group’s expansion plans, disclosing that it is excited about the vast opportunities that the new markets present.

He said it is a testament to UBA Group’s confidence in the African economy, providing world-class banking services that meet the continent’s evolving needs.

“UBA’s vision is clear – we are building a truly global institution anchored in Africa, but serving customers across continents. Further strategic expansion positions us to unlock new opportunities, support intra-Africa trade, and deliver world-class banking experiences wherever our clients choose to do business,” Alawuba stated.

READ ALSO: UBA Gross Earnings Rises By 143% In 2023, Profit Hits N757.7bn

“In Europe, UBA has operations in the United Kingdom and is upgrading its license in France, expanding its capacity to serve cross-border trade, investment flows, and the African diaspora, complementing our over 40-year presence in NY. These moves signal a clear message of UBA’s intent to reshape the competitive landscape,” Alawuba further stated.

The journey of UBA to become Africa’s most diversified financial services group has become evident, as more than 51.7% of the Group’s revenues came from operations outside of Nigeria.

The Group’s aim to provide its rapidly expanding global clientele with cutting-edge financial solutions is in line with the international strategic goal.

The plan highlights UBA’s distinct position as Africa’s global bank and its capacity to take advantage of expansion prospects in both established and developing African markets.

READ ALSO: UBA Announces Changes To USSD Banking Charges

In 2004, the Group entered Ghana, marking the beginning of its Pan-African journey. It quickly expanded into 18 other African markets. UBA is still pushing the envelope today as a resilient, forward-thinking organization that links Africa to the world and the world to Africa.

As part of the Group’s plan to expand its global presence, UBA, in January, announced plans to open operations in Saudi Arabia.

Operating in twenty African countries and the United Kingdom, the United States of America, France and the United Arab Emirates, UBA provides retail, commercial and institutional banking services, leading financial inclusion and implementing cutting-edge technology. United Bank for Africa is one of the largest employers in the financial sector on the African continent, with 25,000 employees across the group’s branches worldwide and serving over 45 million customers globally.