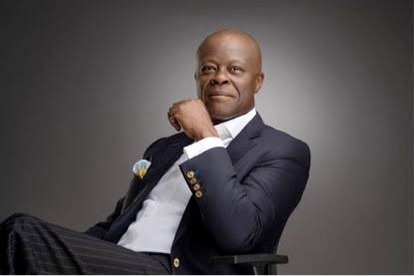

The Chief Executive Officer of JPMorgan Chase, Jamie Dimon has stated that the world is at risk of the “most dangerous time” in decades due to last week’s provocation and retaliation by Israel in Gaza at a time the world is yet to recover from the ongoing war between Russia and Ukraine.

According to him, “the war in Ukraine compounded by last week’s attacks on Israel may have far-reaching impacts on energy and food markets, global trade, and geopolitical relationships.” Hamas, which the US and the European Union have designated a terrorist group, attacked Israel last week to which the latter has fiercely responded.

Join our WhatsApp ChannelPrime Business Africa reports that Russia’s wholesale invasion of Ukraine on the 24th of February 2022 triggered a massive shock to the global economy, especially to energy and food markets, squeezing supply and pushing up prices to unprecedented levels. The economic cost of the world still reverberates across the world up till the present.

READ ALSO: Israel-Gaza Shame: A Festering Cancer To Global Peace

The latest conflict between Israel and Hamas has been identified as having the potential to disrupt the world economy. It is estimated that in the event that an escalation brings Israel into direct conflict with Iran, a supplier of arms and money to Hamas, oil prices could soar to $150 a barrel and global growth drop to 1.7 per cent — a recession that takes about $1 trillion off world output. It is feared that there may be a replay of the Arab-Israeli war of 1973, which led to an oil embargo and years of stagflation in industrial economies.

Speaking yesterday during the release of his company’s third-quarter 2023 earnings results that the world may be encountering, the Chairman of JPMorgan Chase projected that this is “the most dangerous time the world has seen in decades.”

Noting that “U.S. consumers and businesses generally remain healthy,” he however pointed out that “persistently tight labor markets as well as extremely high government debt levels with the largest peacetime fiscal deficits ever are increasing the risks that inflation remains elevated and that interest rates rise further from here.”

Dimon observed that “we still do not know the longer-term consequences of quantitative tightening, which reduces liquidity in the system at a time when market-making capabilities are increasingly limited by regulations.”

The JPMorgan top executive had last week explained that there are two “extraordinary” storm clouds happening today that may have “bad outcomes” for the United States economy. He similarly said that the fiscal money being spent in the U.S. “is so big, the largest in peacetime ever … with very high deficits and QT we’ve never had.”

The executive also recently warned of stagflation and that the Federal Reserve could raise interest rates to 7 per cent. Emphasizing that stagflation is the worst outcome economically, he warned: “If that happens, you’re going to see a lot of people struggling.”