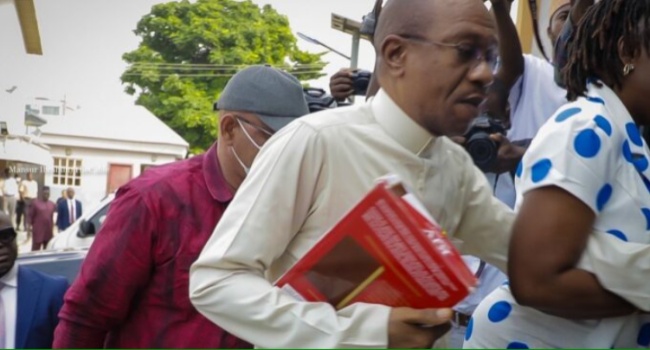

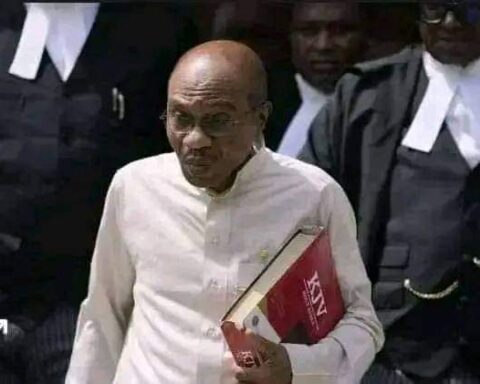

Former Central Bank Governor Godwin Emefiele, who is currently cooling off in the Kuje Custodial Centre over N1.2bn procurement fraud, has been accused of using proxies to acquire Union Bank of Nigeria for Titan Trust Bank Limited, as well as Keystone Bank for himself without any evidence of payment.

This claim was made in a report of the special investigation into the activities of the Central Bank of Nigeria (CBN) which went on to recommend that the government nationalises (that is taking over) the said banks.

Join our WhatsApp ChannelIn the report submitted to President Bola Tinubu mid week, the Special Investigator Sam Obazee disclosed that while officially Union Banks mysterious shareholder is said to be domiciled in the UAE, “It was found that these entities do not have physical presence in Dubai as claimed.

“This contravenes Section 3 (5) of the Banks and Other financial Institutions Act, 2020. Accordingly, they are not supposed to be allowed to operate or acquire a bank in Nigeria.”

According to the report, “when we carried out investigation, we discovered that some persons were used as proxies by Mr. Godwin Emefiele to set up Titan Trust Bank and acquired Union Bank therefrom. All from ill-gotten wealth.”

On Keystone Bank, the investigator said in the report, “when we carried out investigation, we discovered that some persons were used as proxies with the connivance and assistance of Mr. Godwin Emefiele and the CBN to acquire Keystone Bank without evidence of payment.”

Immediately after a government organisation linked to Central Bank made a deposit of N20bn into Heritage Bank, the report said a loan of N25bn was issued to a vehicle associated with Emefiele and this money was then put forward as payment for Keystone Bank. “Upon acquisition, Keystone Bank then returned the N25bn to Heritage Bank as placement.

“When the loan granted to the vehicle matured with outstanding balance, the MD of Heritage Bank called for repayment. Unfortunately for the shareholders of the bank could not repay.

“Consequently, the MD of Heritage got his lawyers to write to the bank on two occasions – threatening to take over Keystone Bank based on the shares they had pledged as security. After much pressure, Keystone Bank created internal loans of about N50b between June and October 2029 and moved the proceeds to repay Heritage Bank on behalf of the shareholders.

“Based on this Emefiele had mounted pressure on the bank for these loans to be crated within Keystone bank on behalf of their group. However, the MD of the bank at that time resigned due to the consistent pressure from Emefiele and the shareholders to comply.”

In his letters to President Bola Tinubu who appointed him into the position in July, Obazee said he had completed his investigation into the illegal acquisition of Union Bank by Titan Bank, and was on the verge of recovering the two banks for the Federal Government.

His words, “we were able to secure some documents and investigation reports will lead to the forfeiture of the two banks – Union and Keystone Bank (along with Titan Trust Bank) to the Federal Government.”

In the course of the investigation into the sale of Union Bank, the report added, “the Special Investigator contacted the Nigeria Embassy in UAE to verify the physical presence of Luxis and Magna in UAE as well as their corporate status.

“It was found that these entities do not have physical presence in Dubai as claimed.

“The Special Investigator probed into the activities of the Titan Trust Bank (acquirers of Union Bank) and discovered that there is a mysterious shareholder who has given interest free long term loan (with no fixed repayment schedule) to the entities mentioned in (1) above. This mysterious shareholder is believed to be Mr. Godwin Emefiele.”