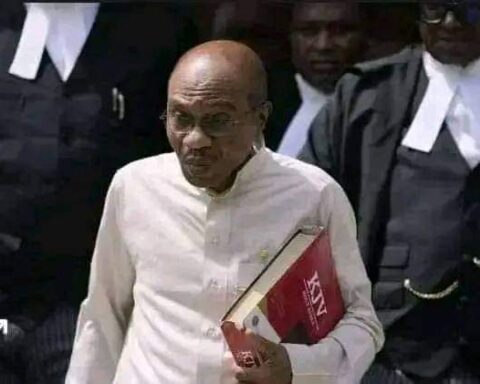

Following the submission of the report of the Special Investigation on Central Bank of Nigeria and Related Entities (Chargeable offences) to President Bola Tinubu this week, former CBN Governor, Godwin Emefiele might be in for fresh criminal charges over the handling of the naira redesign policy under his stewardship at the central bank.

Prime Business Africa recalls that Tinubu had in a letter dated 28th of July, 2023 personally signed by him, appointed former Chief Executive Officer of Financial Reporting Council of Nigeria (FRC), Jim Obaze, charging him to “investigate the CBN and related entities using a suitably experienced, competent and capable team and work with relevant security and anti-corruption agencies to deliver on this assignment”.

Join our WhatsApp ChannelEmefiele, who is currently in Kuje Custodial Centre over N1.2 billion procurement fraud, alongside Tunde Sabiu, erstwhile personal security to former President Muhammadu Buhari, The Punch reports, could be prosecuted for illegal issuance of currency under section 19 of the CBN Act. Twelve top directors of the apex bank may also be facing the music.

The controversial naira redesign policy was said to have been sold to Buhari at the instance of Sabiu, who wielded so much influence in the administration, and that the initiative was implemented without the approval of the board of the CBN.

According to the report submitted by Obaze, the Special Investigator, Buhari did not approve the naira redesign. It was Tunde Sabiu who first told Emefiele in September 2022 to consider the redesign of the naira. On the 6th of October, 2022, Emefiele wrote to Buhari that he wanted to redesign and reconfigure N1000, N500 and N200 notes.

“The former President tagged along but did not approve the redesign as required by law. Buhari merely approved that the currency be printed in Nigeria. The redesign was only mentioned to the board of the CBN on December 15, 2022, after Emefiele had awarded the contract to the Nigerian Security Printing and Minting Plc on October 31, 2022,” the special investigator found out.

The documents have it that Emefiele contracted the redesign of the naira to De La Rue of the UK for £205,000 pounds under the vote head of the Currency Operations Department after the NSPM said it could not deliver the contract within a short timeframe.

It was said that N61.5bn was earmarked for the printing of the new notes out of which N31.79bn had been paid. As of the 9th of August, 2023, findings by the special investigator revealed that N769bn of the new notes were in circulation.

There may be more to the said report given that the immediate past President only a month ago owned up to endorsing the redesign of Nigeria’s legal tender. Buhari, in his first interview since leaving office on May 29 this year, was even proud of his work when he said the naira redesign was approved in the twilight of his administration to “protect his integrity and to show Nigerians there was no shortcut to success.”