FBN Holdings has called on security agencies to fish out authors of fake report purporting that its management released N400 billion new notes to the Presidential candidate of the All Progressives Congress (APC), Bola Ahmed Tinubu, as Nigerians reel under the weight of Naira scarcity following a currency redesign project of the apex bank.

Titled “MALICIOUS PUBLICATION- A REBUTTAL,” FBN’s reaction followed a cogent denial by the Economic and Financial Crimes Commission (EFCC) few hours after the fake report.

Join our WhatsApp ChannelREAD: EFCC Denies Raid On Tinubu’s Home

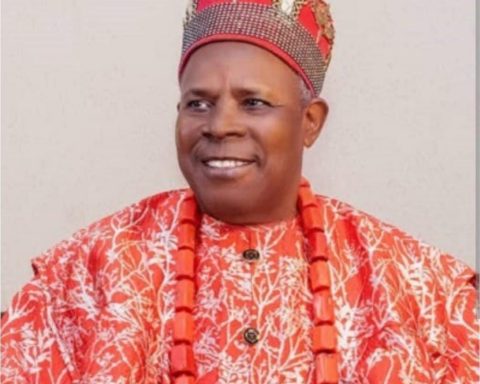

The unverifiable online platform had given itself away when it mentioned managing director of First Bank Nigeria, a subsidiary of the FBN Holdings, as culprit in the alleged transaction, but turned around to use the name and photograph of Nnamdi Okonkwo, the Group Managing Director of the holding company, FBN, to support its claim.

But FBN Holdings, in a statement it made available to Prime Business Africa on Monday morning, described the report as fake story attempting to damage the country’s banking system at large by dragging it into the murky waters of politics.

What FBN is saying:

“Our attention has been drawn to false news making the rounds that an order of arrest has been made against the MD of FirstBank whilst using the name and image of the GMD of FBN Holdings,” the Management said.

“We wish to state categorically that this is fake news, which has already been debunked by EFCC in their publication titled “EFCC Did Not Raid Tinubu’s Home” and signed by the Commission’s Head, Media & Publicity on its verified twitter handle.”

The statement stressed that neither the Managing Director of the Bank nor the Group Managing Director of the Holding company, Nnamdi Okonkwo, had any involvement with the matters alleged in the fictitious news story.

The bank emphasised that there is no order of arrest against any one of them.

“The public should disregard this and all such similar stories whilst the authorities are called upon to fish out the perpetrators of this malicious story,” it said.

About FBN Holdings

FBN Holdings Plc is a leading African banking and financial services group serving individuals, businesses, organisations and governments in leading markets across the continent and globally. FBNHoldings’ principal bank subsidiary is First Bank of Nigeria Limited (FirstBank), Nigeria’s foremost financial institution and leading banking services provider. FirstBank has forged an incredible partnership with its people and built an enduring heritage through a vast array of seasons and societies, to remain an icon of Gold Standard in today’s financial services industry in Africa and beyond.

FirstBank with operations in 10 countries, with subsidiaries that includes FBNBank (UK) Limited, FBNBank in the Democratic Republic of Congo, Ghana, The Gambia, Guinea, Sierra-Leone and Senegal, and First Pension Custodian Limited.

Others are the Merchant Banking and Asset Management businesses, which comprise FBNQuest Merchant Bank Limited, FBNQuest Capital Limited, FBNQuest Securities Limited, FBNQuest Asset Management Limited, FBNQuest Trustees Limited and FBNQuest Funds Limited.

Also, FBN Holdings Plc with this divestment still have left in its insurance business line as subsidiary: FBN Insurance Brokers, a reputable brokerage company.

READ ALSO: CBN Ratifies Indian Director For Sterling Bank

Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama

- Uduegbunam Chukwujama