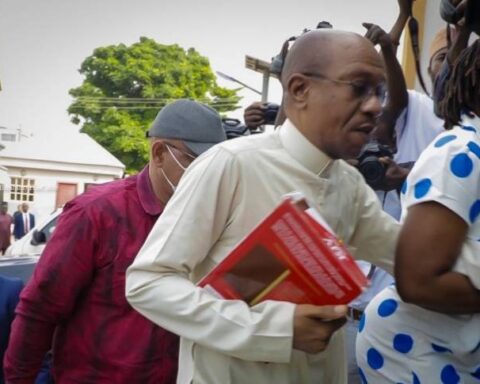

Justice Lateefat Okunnu of the Lagos State High Court Sitting in Ikeja, Lagos, has sentenced Francis Atuche, the

former managing director of the defunct Bank PHB to 6 years in prison at the Kirikiri maximum correctional

facility in Lagos, after a 10-hour court proceeding.

Atuche was convicted alongside Ugo Anyanwu, the former Chief Financial Officer of the Bank. The two suspects were charged to court by the Economic and Financial Crimes Commission (EFCC) on 27 counts of conspiracy to commit felony and stealing. Atuche was found guilty on counts 1,3,5,7,9 and 23 while Anyanwu was found guilty on counts 2,4,6,8,11,12 and 24 of the amended charge.

Join our WhatsApp ChannelAccording to Justice Okunnu, Atuche would serve 6 years jail term while Anyanwu would serve a 4 years jail term, the judgment is coming after 12 years of trial.

While delivering judgment, Justice Okunnu held that the EFCC had successfully presented their case and proved

their points against the suspects beyond reasonable doubts. The Judge explained that Atuche and Anyanwu abused their powers and corruptly took advantage of their positions to give undue financial benefits to themselves at the expense of the bank and depositors and also without regard for the banks’ health.

She further stressed that the suspects stole from the bank and depositors and because of their action, taxpayer’s money was used to bail out the bank after established rules and regulations had been purposefully ignored to put the bank and depositors funds at risk.

The judge ruled that the defendants were to make restitution of the siphoned money, a sum of N25.7billion back to the bank. She rejected claims by the defendants suggesting that the convicts were merely professionally negligent.

Recall that EFCC had accused the suspects of fraudulently acquiring about N25.7billion belonging to Bank PHB for themselves, using the money fraudulently acquired to purchase a huge amount of shares from the same bank.

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan

- Kayode Shopekan