United Capital Plc has appointed four senior infrastructure investment professionals to the Investment Committee of its ₦150 billion United Capital Infrastructure Fund (UCIF).

Prime Business Africa has learned that the move was to scale infrastructure projects across Nigeria and the wider African region.

The appointments, approved by the Securities and Exchange Commission (SEC), are also aimed at improving governance and boosting the fund’s capacity to deliver long-term returns.

Join our WhatsApp ChannelUCIF currently invests in sectors including power, industrial recycling, renewable energy and gas infrastructure, and has posted a year-to-date gross return of 24.62 per cent.

Commenting on the appointments, Group Chief Executive Officer Peter Ashade said: “These new members bring extensive experience across multiple jurisdictions. Their expertise will help UCIF deepen its governance framework and expand its infrastructure investments across Africa.”

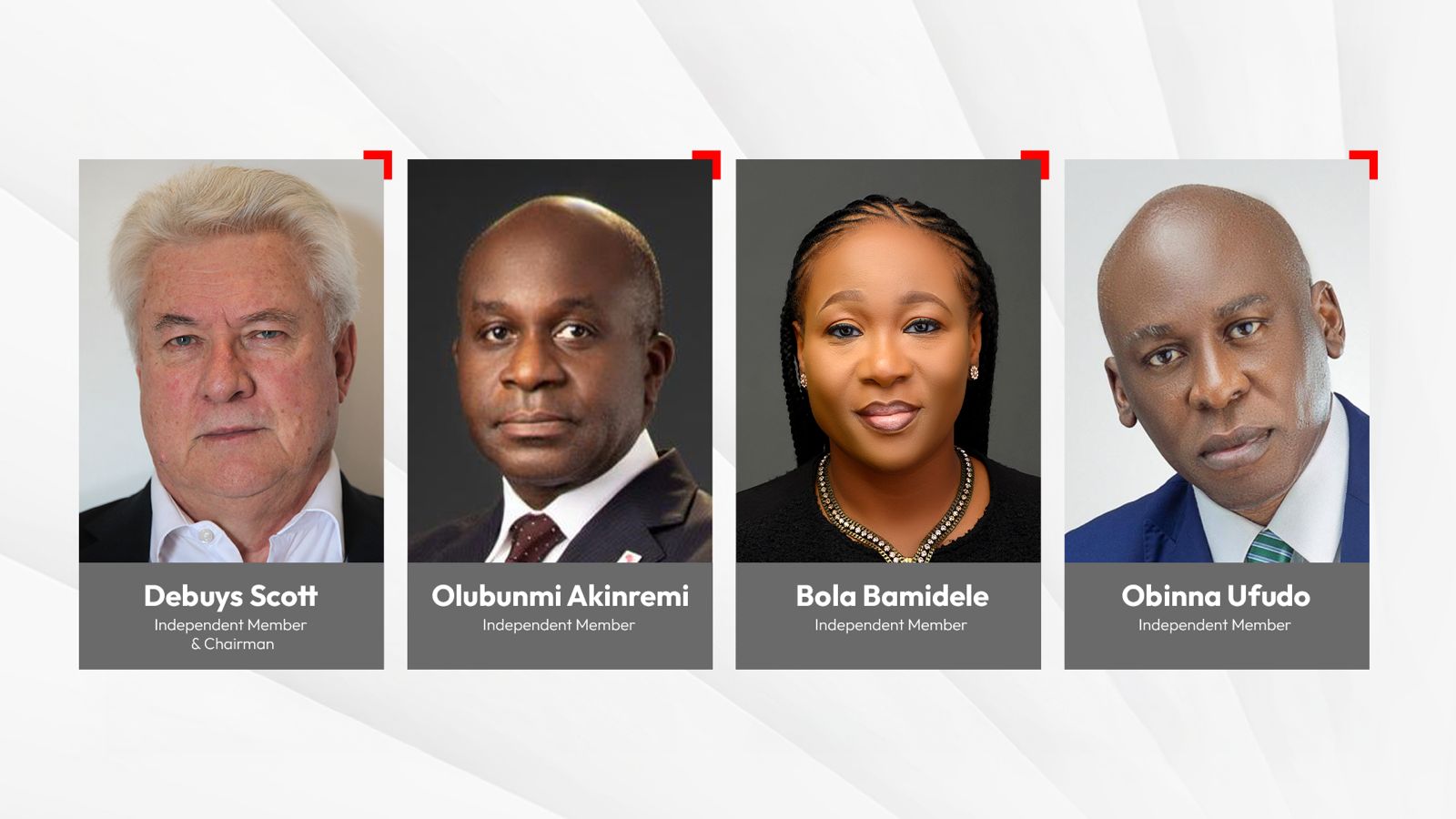

The newly appointed members are De Buys Scott, who will serve as Chairman, alongside Olubunmi Akinremi, Bola Bamidele and Obinna Ufudo.

They join existing committee members Odiri Oginni, UcheNna Mkparu and Adeyinka Jafojo.

Samuel Nwanze exited the committee following the completion of his tenure.

De Buys Scott is Managing Partner at Cornerstone Infrastructure Advisors and a former Senior Partner for Infrastructure at KPMG South Africa.

He told reporters: “My focus will be on strengthening public-private partnerships and ensuring that UCIF’s investments create sustainable impact across sectors such as healthcare, transportation and real estate.”

Investors Snubbed Infinity Trust, LivingTrust For Abbey Mortgage Bank In 2025

NNPCL Posts ₦5.4tn Profit in 2024, Unveils Roadmap to Attract $60bn Investments by 2030

Hosting IATF 2027 Will Expand Nigeria’s Exports, Attract Foreign Investments – LCCI

Olubunmi Akinremi, CEO of Tocam Capital, added: “We aim to leverage experience from both local and international markets to deliver long-term value for investors while supporting Nigeria’s infrastructure growth.”

Bola Bamidele, who retired from the World Bank Group after nearly 25 years, said: “Our work will focus on structuring investments that not only generate returns but also address critical infrastructure gaps across Africa.”

Obinna Ufudo, former CEO of Transnational Corporation of Nigeria Plc (Transcorp), highlighted the fund’s strategic potential: “UCIF can play a pivotal role in mobilising capital for projects that drive economic development and social impact across the region.”

UCIF is a closed-ended, SEC-licensed fund targeting healthcare, agribusiness, renewable energy, industrial recycling, gas infrastructure and manufacturing.

Prosper Okoye is a Correspondent and Research Writer at Prime Business Africa, a Nigerian journalist with experience in development reporting, public affairs, and policy-focused storytelling across Africa

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye