Nigeria’s government has offered ₦900bn ($1bn) worth of federal bonds for subscription, as it continues to raise funds in the domestic debt market amid high interest rates.

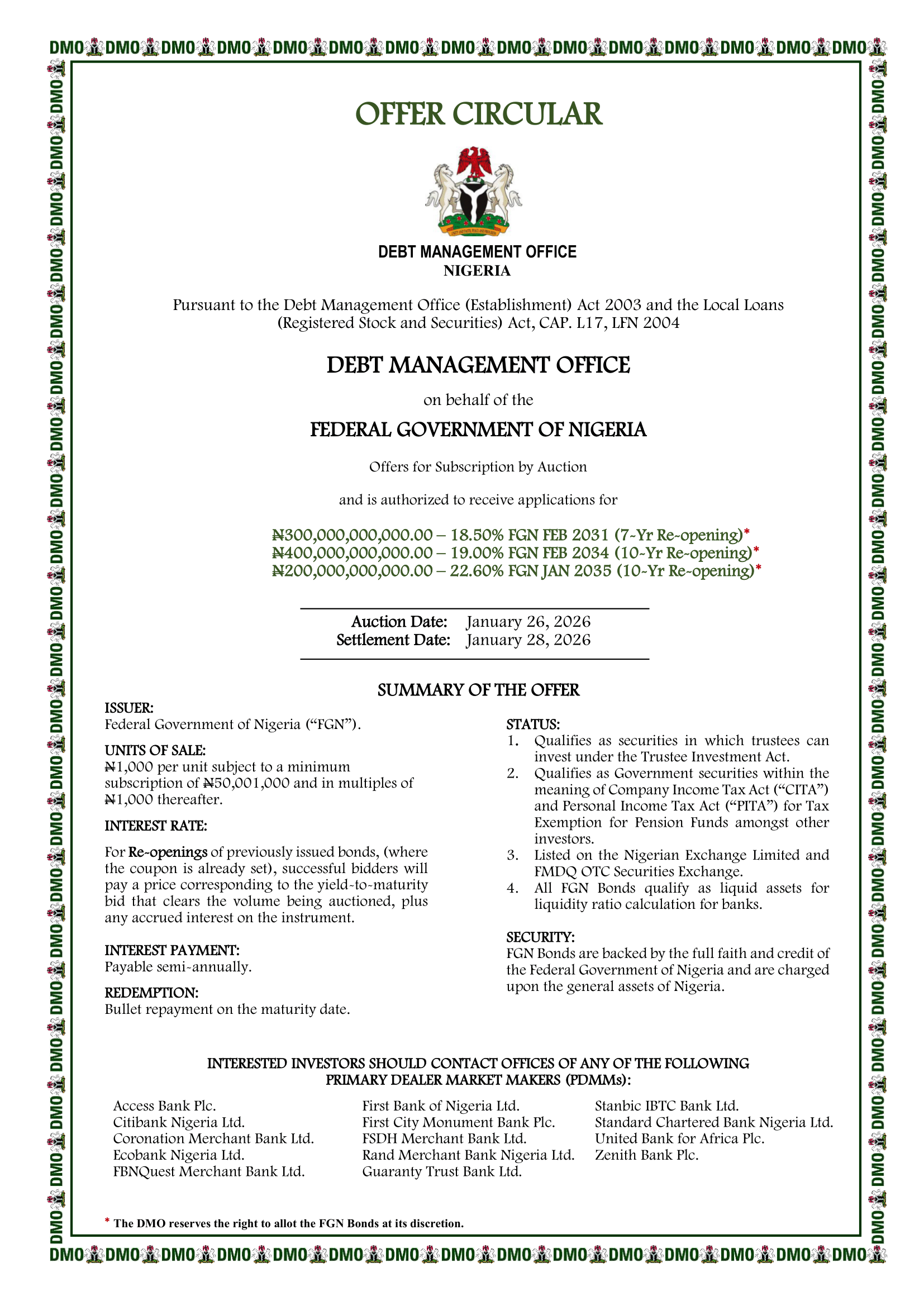

In a statement, the Debt Management Office (DMO) said the bonds are being sold at ₦1,000 per unit across three separate instruments with maturities ranging from 2031 to 2035.

The largest tranche is a ₦400bn 10-year bond due in February 2034, carrying an annual interest rate of 19.0%. This is followed by a ₦300bn seven-year bond maturing in February 2031 at 18.5%, and a ₦200bn 10-year bond due in February 2035 with a coupon of 22.7%.

Join our WhatsApp ChannelThe DMO said the auction involves the re-opening of previously issued bonds, meaning successful bidders will pay prices based on the yield-to-maturity that clears the auction, plus any accrued interest.

Interest payments will be made annually, with the principal repaid in full at maturity.

The agency added that federal government bonds are backed by the “full faith and credit” of the Nigerian government and are charged against the country’s general assets.

The bonds are eligible investments under Nigeria’s Trustees Investment Act and qualify as government securities for tax exemption purposes under company and personal income tax laws, including for pension funds.

Why Investing In Bonds Can Help In Sustainable Savings

DMO Launches Subscription For July 2025 FGN Savings Bonds, Offers Attractive Interest Rates

Nigeria Launches N590bn Power Sector Bond to Clear GENCO, Gas Arrears

They are also listed on the Nigerian Exchange and the FMDQ OTC Securities Exchange, and qualify as liquid assets for banks’ liquidity ratio calculations.

Prosper Okoye is a Correspondent and Research Writer at Prime Business Africa, a Nigerian journalist with experience in development reporting, public affairs, and policy-focused storytelling across Africa

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye

- Prosper Okoye