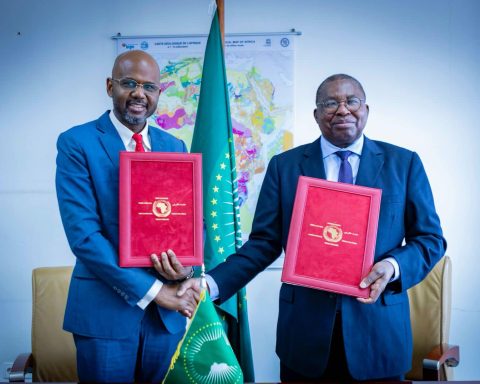

Shelter Afrique is partnering the African Development Bank, AfDB, to develop a Sovereign Lending product and supplement its traditional products in housing value chain.

The pan-African housing development financier, in a statement it made available to Prime Business Africa, on Tuesday, disclosed the latest partnership with AfDB would see the company attend to both the demand and supply sides of the housing value chain.

Join our WhatsApp ChannelThe Statement quoted Shelter Afrique’s Acting Managing Director Kingsley Muwowo as saying, in Nairobi, that Africa’s GDP contraction resulting from COVID-19 pandemic was an alarming sign of slump in the inclusive housing goals in many countries. Muwowo, therefore, explained that his company needs to respond to the risk of a possible governments’ disengagement, while revitalizing its financial agility.

READ ALSO: Shelter Afrique Offers $18.5m Loan To MSD For Housing Projects In DRC

“The COVID pandemic,” Munowo further says, ”has brought in an era of economic distress throughout Africa with an average of -3.6 per cent recession in 2020, the first recession in SSA in 25 years.

”In response, Shelter Afrique recently reviewed its corporate strategic plan with the aim of aligning itself to its members’ priorities and position the company for better performance and enhanced development impact. One of the result of this strategy review is the decision to develop a Sovereign Lending product to serve our member states.”

Munowo remarked that the company currently offers various products and related services, including project finance, institutional lending, equity investments & joint ventures, trade finance, and social housing, to support the delivery of affordable housing and commercial real estate.

On Capacity building, Mr. Muwowo, who spoke at a three-day in-house capacity building on sovereign lending organized by Shelter Afrique and facilitated by the AfDB through its training arm, the African Development Institute, said ,through training, the company aims to expand its capacities for funds absorption from the anticipated new business development, carry out product design and development, as well as support the organization’s various departments to ensure the product is developed and executed effectively.

“Internally, these activities will be executed through experts in various departments in liaison with the African Development Institute to ensure the product is well in line with the market needs of our member States,” Mr. Muwowo said.

African Development Institute Divisional Manager, Mr. Chidozie Emenuga said the partnership with Shelter Afrique was part of the Africa Development Bank Group commitment to step up its efforts to help overcome the capacity constraint in Africa.

“Capacity development is key to realizing major development goal including the SDGs- which encompasses housing for all, the Addis Ababa Accord on Accelerating Development Financing, the African Union’s Agenda 2063, and national development goals of African countries,” Mr. Emenuga said.

PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter