The Nigerian Content Development and Monitoring Board (NCDMB) and the Bank of Industry (BoI) have signed an amendment to the Memorandum of Understanding (MoU) on the $50 million NOGaPS Manufacturing Fund.

The Fund was created by the NCDMB and domiciled with BoI to attract oil and gas equipment manufacturers to the Nigerian Oil and Gas Parks Scheme (NOGaPS) facilities established by the NCDMB, and increase access to affordable finance by the manufacturing entities.

Join our WhatsApp ChannelREAD ALSO: NCDMB Join Forces With Stoilic Shipping On Cadets Training

The signing of the amended MoU took place in Lagos on Friday, 25 August during the 2023 second quarter Review Meeting of the Nigerian Content Intervention Fund (NCIFund).

In his remarks, the Executive Secretary, NCDMB, Engr Simbi Kesiye Wabote underlined the tremendous success of the NCIFund in catalyzing capacity development and investments in the Nigerian oil and gas industry. He disclosed that the Fund serves as a model for local content practice across the African continent and inspired the creation of the African Energy Bank by the African Petroleum Producers Organisation (APPO), in partnership with the African Export Bank (Afreximbank).

He added that countries like Angola and Namibia are currently engaging the Board, with a view to understanding the workings of the NCI Fund, so as to replicate same in their jurisdictions.

He said: “today, Angola is thinking of establishing a similar credit line for their oil and gas companies. I think the parliament recently approved some sum of money for them to manage in that respect. Namibia is planning to do the same with the potential enactment of a Local Content Act.”

Wabote further commended the Bank of Industry for the successes being recorded in the management of the NCI Fund, assuring that the Board will continue to look for other opportunities to increase its partnership with BoI.

“Considering the effectiveness and success recorded by BoI, NCDMB may consider inviting BoI to send a nominee that will act as independent Director to the Board of Directors of some of the companies that we have invested equity in. This will help them overcome some of the prevailing issues around governance, liquidity and technical optimization,” Wabote stated.

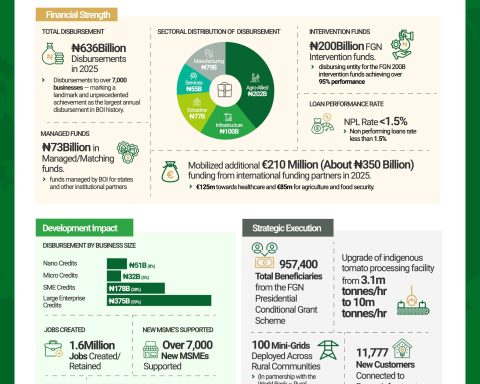

On his part, Managing Director of BOI, Mr Olukayode Pitan expressed confidence in the future performance of the Board’s funds domiciled in the bank while noting that these quarterly review meetings will impact on sustaining the effective disbursements and recovery of these funds.

According to him, the NCI Fund is performing excellently with 194 applications equalling US$1 billion /₦80.6 billion with 69 disbursements totalling US$324 million /₦38.4 billion as at the day of reporting.

The Board established the NCI Fund in 2018 with the purpose of financing Oil and Gas companies to increase capacity and grow Nigerian Content in the Industry Presently, the NCI Fund has five product lines which are being managed by the Bank of Industry. They include: Manufacturing Finance – $10 milion; Asset Acquisition Finance – $10 million; Contract Finance – $5 million; Loan Refinance – $10 million and Community Contractor Finance – ₦20 million.

The US$50 million NOGaPS Fund was launched as a separate product in March 2023 to incentivize companies that will be domiciled and manufacture oil and gas equipment components within the NCDMB oil and gas parks being established at different locations across the country, with the sites in Bayelsa and Cross River State open for occupation.

The Board also has a US$30 million Working Capital Fund for oil and gas service companies and US$20 million Fund for Women in Oil and Gas Intervention Fund. The last two facilities are administered by the Nexim Nigerian Export-Import Bank and the agreements were signed in mid-2021.