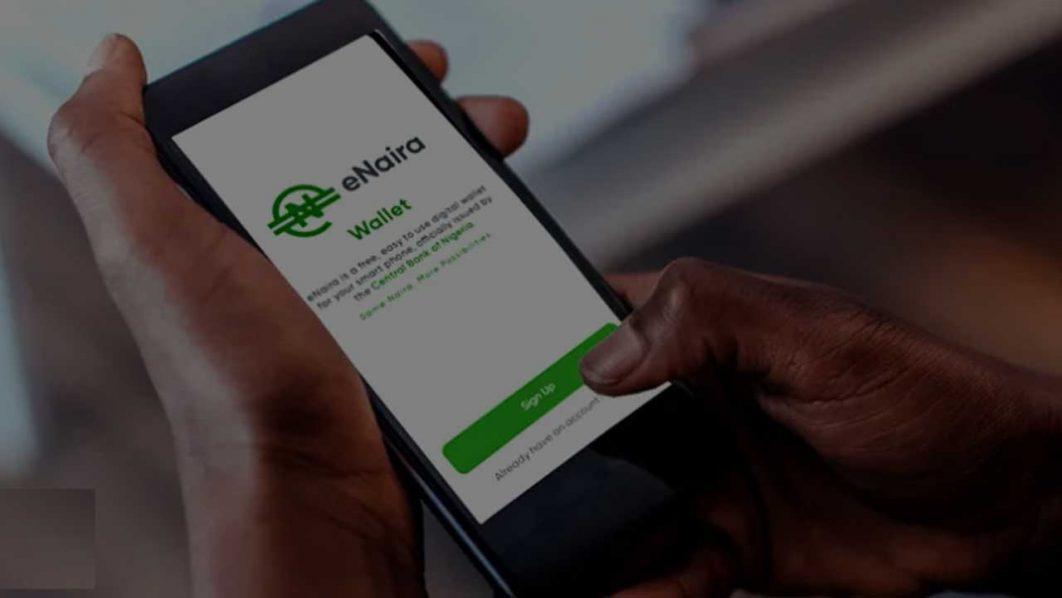

eNaira, the Nigerian digital currency, has been ranked first on PricewaterhouseCoopers (PwC) Global Index of top retail Central Bank Digital Currencies (CBDCs).

Retail CBDC projects are digital currencies designed for public use.

Join our WhatsApp ChannelThis was obtained from the PwC’s 2022 CBDC Global Index and Stablecoin Overview which analyses and ranks the leading retail and wholesale CBDC projects around the world.

In a statement on its website dated April 5, the firm said the report also evaluates the current stage of CBDC project development, while taking into account central bank opinion and public interest.

“Retail projects in the Index are led by the Central Bank of Nigeria’s (CBN) eNaira, the first CBDC in Africa, and the Sand Dollar, issued by the Central Bank of the Bahamas as legal tender in October 2020, making the Bahamas the first country to launch a CBDC,” PwC said.

“China became the first major economy to pilot a CBDC in 2020 with the digital yuan, and as of March 2022, pilot programs are running in 12 cities, including Beijing and Shanghai.”

Recall, the CBN launched the eNaira, the country’s first digital currency, in October 2021. The PwC said around 666,000 eNaira speed wallets have been created as of December 2021.

It was learnt that the application has also recorded 700,000 downloads, while over 35,000 transactions have been conducted on the platform.

According to the report, 90 percent of the transactions was a person to business and vice versa, while the eNaira speed wallet application has been downloaded in 160 countries.

The PwC report also showed that more than 80 percent of central banks are considering launching a CBDC or have already done so.

“The future of money is digital,” PwC said.

The company maintained that retail CBDC projects have reached greater maturity levels than wholesale projects (digital currencies used by financial institutions that have accounts with central banks).

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter

- PBA Reporter