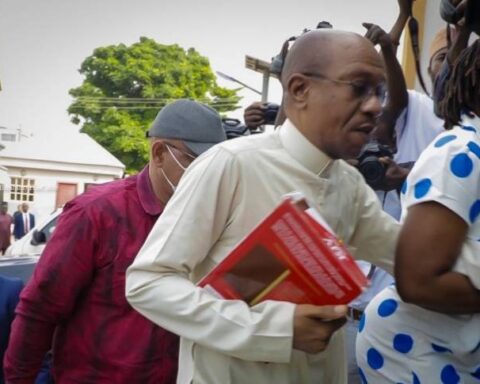

The Nollywood actress, Oluwadarasimi Omoseyin, who was arraigned on Monday by the Economic and Financial Crimes Commission (EFCC), has been granted bail in the sum of N5 million.

Omoyesin was arraigned before Justice Chukwujekwu Aneke of the Federal High Court Ikoyi Lagos on two-count charge bordering on abuse of the new naira notes.

Join our WhatsApp ChannelThe defendant was accused of spraying and matching on the new naira notes at an event centre in the Lekki area of Lagos.

She, however, pleaded not guilty to the charge and was remanded in the correctional centre.

Justice Aneke in his ruling on the bail application on Wednesday ordered the defendant to pay the sum of N5 million with a surety in the same amount.

According to the court, the surety must be employed by the government and possess real estate that is subject to its jurisdiction.

He added that the surety must present three years of tax clearance.

The defendant was however, told to leave her international passport in the custody of the court registrar.

Trial on the matter was scheduled to hold on 3rd April.

The defendant was accused of committing the crime on January 28 at the Monarch Event Center in the Lekki area of Lagos.

She was arrested by operatives of the Independent Corrupt Practices and other Offences Commission (ICPC) on February 1, 2023, and later handed over to the EFCC further investigation and prosecution.

According to the prosecutor, Mr S.I. Sulaiman, the defendant was dancing at a gathering when she allegedly sprayed and matched on newly designed naira notes which violates section 21(1) of the Central Bank of Nigeria Act 2007.

Sulaiman alleged that the defendant engaged in spraying and matching on the newly designed naira notes while dancing at the event.

The offence contravenes the provisions of Section 21 (1) of the Central Bank Act, 2007 and is punishable if found guilty.

Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee

- Peter Okoye, PBA Journalism Mentee