As the challenge of local production and distribution of petroleum products continues to rock Nigeria, a former deputy president of the Nigeria Labour Congress (NLC), Amechi Asugwuni, has advised the Federal Government to consider the option of allowing states access to manage refineries in line with the principle of true federalism.

Asugwuni, who is also a labour relations consultant, said that since private sector players could own and manage refineries states, especially the oil-producing ones should be given the opportunity to establish or acquire the existing ones and manage them to see if that would bring a solution to the recurring scarcity of petrol.

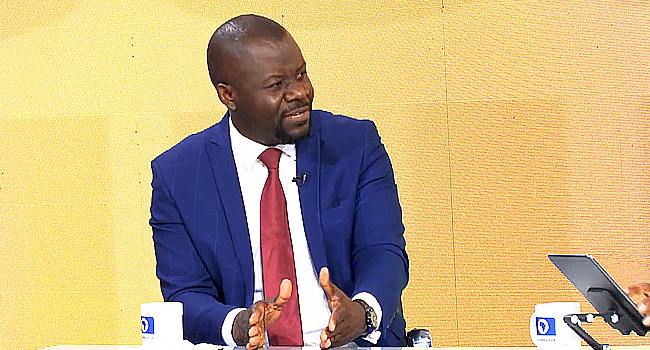

Join our WhatsApp ChannelAsugwuni made the submission while appearing on Channels Television Sunrise Daily on Monday morning.

His suggestion is coming on the heels of the ensuing crisis resulting from the removal of subsidy on petrol by the Federal government last week and the subsequent hike in prices of the product across the country.

He said: “If state governments, especially from Niger Delta would take up the responsibility to collaborate with Federal Government to put in effort to cause refineries to work, let it be that it is now the state business. If the Federal Government can even sell it to the states to manage; if that becomes the solution upon which labour will share the burden I think Nigerians would also give it a trial,” Asugwuni said.

NLC has kicked against the increase in the pump price of fuel by the Nigeria National Petroleum Company Limited (NNPCL) and subsequently declared its intention to embark on a nationwide strike starting from Wednesday if the government does not reverse the price.

According to Asugwuni, the position of NLC is that fuel subsidy payments should end given the huge financial burden on the government but that necessary conditions to mitigate the impact on Nigerians should be put in place.

He said: “But in the absence of plan to activate the refinery and you just want labour to talk about their minimum wage, it is not going to work,” he added.

He said the decision of NLC leadership to boycott the Sunday meeting with the Federal Government which was attended by the Trade Union Congress (TUC), was to send a message to the government that it is not out for a play on issues regarding the fuel subsidy removal.

On the prospects of the Dangote refinery addressing the petroleum product supply challenges when it commences operations this year, the former NLC deputy president argued that it would not be nice to subject the entire consumption needs of Nigerians to the facility.

READ ALSO: NLC Fears Dangote Refinery Could Become Dictator, Doubtful Over Price

He equally canvassed for a sincere initiative that would allow private sector players come into the industry.

Victor Ezeja is a passionate journalist with seven years of experience writing on economy, politics and energy. He holds a Master's degree in Mass Communication.