Nigeria is losing investors to G-7 securities – United States, Germany, France, Japan – as creditors avoid underdeveloped and developing countries to protect their investment.

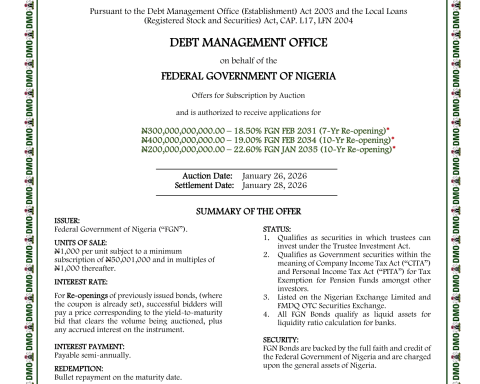

According to Director-General of the Debt Management Office (DMO), Patience Oniha, Nigeria is unable to attract investors to its bonds, and this reduced the amount FG planned to borrow.

Join our WhatsApp ChannelOniha revealed that last year, Nigeria wanted to raise $6 billion, but due to low interest from international creditors or investors, the country could only obtain $4 billion.

She stated that this year, the country has only been able to borrow $1.25 billion. The difficulty in borrowing funds comes amid downgrade of Nigeria’s credit rating to Category ‘B’ economy by credit ratings firms, Moody’s and Fitch.

Addressing the situation, Oniha said, “Where there is an issue is the new external borrowings. What was provided for in the 2022 budget is N2.57tn of new external borrowings and this, in naira terms at the budget exchange rate, is $26bn.

“The reality is that if it were before, by now we would have issued Eurobonds to raise the money and we would be in good business.

“But let us say from the fourth quarter of last year, the international capital markets have not been open to countries like Nigeria. So, in 2021, there was about $6bn to raise. We raised $4bn for that one. But this year, it is $1.25bn.

“The international markets are not looking for countries with our ratings –B ratings. The invasion of Ukraine by Russia, as you know, turned around things in the world significantly.

“So, inflation rates are high, interest rates are high and investors are saying there are a lot of uncertainties as to what will happen. There is a threat of recession.

“So, what they have decided to do is to put their money in the G-7 securities: United States, Germany, France, Japan, and so on. Those countries also issue bonds. So, that is where the investors are putting their money and rates have gone up significantly,” Oniha said.

Nigeria is preparing for important general elections in 2023 that will usher in a new administration for its central government as well as for its sub-national governments.