The United Bank for Africa (UBA) has paid out a total of N171 billion as dividends to its shareholders for the fiscal year 2024, reflecting a 79 per cent increase from the N95.8 billion paid in 2023.

According to the bank’s 2024 financials, filed with the Nigerian Exchange Limited (NGX), it proposed a final dividend of N3.00 kobo for every ordinary share of 50 kobo for the financial year ended December 31, 2024, bringing the total dividend in the year to N5.00 kobo.

Join our WhatsApp ChannelThis was ratified by shareholders during the 63rd Annual General Meeting (AGM) of the banking group held in Abuja.

When combined with the N2 interim dividend, it results in a total dividend payout ratio of 23 per cent for fiscal year 2024. In FY 2023, the group’s total dividend payout ratio was 16 per cent.

According to the 2024 financials of the bank, its profit before tax rose by 6.1 per cent from N757.68 billion recorded at the end of the 2023 financial year to N803.72 billion in 2024. The record also shows that the bank’s profit after tax went up from N607.7 billion in 2023 to N766.6 billion in 2024, representing a 26.14 per cent growth.

READ ALSO: UBA Unveils Upgraded PoS Terminal, Revamped MONI App To Accelerate Digital Payments Across Africa

The bank’s gross earnings also increased by 53.6 per cent from N2.08 trillion at the end of the 2023 financial year to N3.19 trillion in the period under review.

As in previous years, the bank’s total assets increased significantly by 46.8 per cent, from N20.65 trillion in 2023 to N30.4 trillion in December 2024, indicating a watershed moment for the bank with the broadest reach across the continent.

READ ALSO: UBA Raises N355.2bn Of N500bn CBN’s Capital Requirement

Consequently, UBA Group Shareholders’ Funds rose from N2.030 trillion as of December 2023 to close the 2024 financial year at N3.419 trillion, achieving an impressive growth of 68.39 per cent.

UBA has increased its payout to shareholders as a reward for its outstanding performance in 2024.

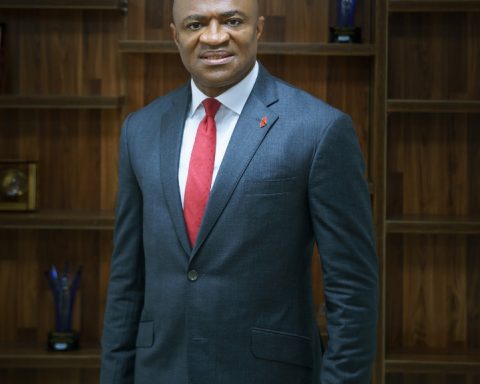

Speaking on dividend yield, the UBA Group GMD/CEO, Oliver Alawuba, said the bank has the highest among Nigerian stocks, with a 14.8 per cent dividend yield. Alawuba assured that the bank will continue to increase its return to shareholders, saying, “What we can assure our shareholders today is that UBA will continue to pay more dividends.”

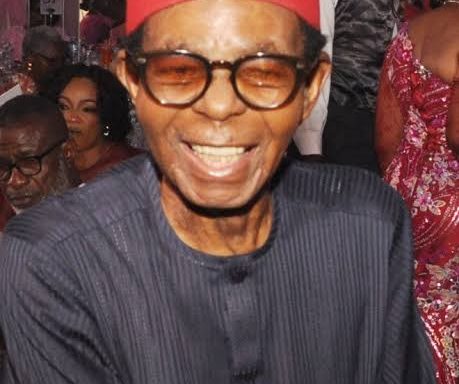

The UBA Group Chairman, Mr Tony Elumelu, revealed during the AGM that the bank has so far raised its capital to N355.2 billion. This new capital base was achieved after the bank raised N240 billion through rights issue in the last quarter of 2024. Elumelu said the bank plans another rights issue in Q3 2025 to complete the N500 billion minimum capital requirement. “The final capital raise is expected to be completed in Q3 2025, well ahead of the CBN deadline,” Mr Elumelu stated during the AGM.