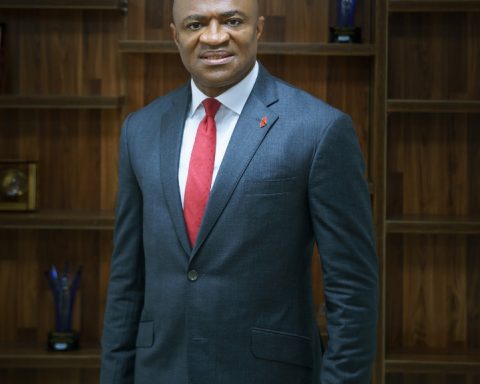

Group Managing Director, United Bank for Africa (UBA) Group, Mr Oliver Alawuba, has revealed that the bank is committed to achieving a target of 45 per cent deposit growth, 40 per cent loan growth, and a return on average equity of 28 per cent in 2024.

He added that the bank is also working towards achieving a 2.8 per cent return on average assets, and net interest margin of 8.5 per cent and 28 per cent Capital Adequacy Ratio.

Join our WhatsApp ChannelAlawuba made this known during the bank’s Investors’ Conference held on Thursday.

Speaking on UBA’s performance in the first half (H1) of 2024, the GMD said despite challenges in the economic environment, the bank was able to record strong double-digit growth across all key metrics.

He attributed it to the bank’s commitment to the principles of enterprise, excellence, and execution of strategic goals.

Alawuba noted that a combination of “strong leadership, a dedicated team, supportive customers and a clear strategic direction” enabled the bank to achieve “sustained and profitable growth.”

The UBA GMD gave an overview of the economic environment at both global and regional level where the bank operate, highlighting challenges such as high inflation, rising debt levels, increasing interest rates, tighter monetary policies, geopolitical tension and climate change.

“Despite these headwinds, our Bank has demonstrated resilience,” Alawuba stated.

“We have remained focused on navigating these challenges while upholding the ideals of enterprise, excellence, and Execution (3 Es),” he added.

UBA H1 2024 Results

Giving a breakdown of UBA’s H1 2024 financial result, Alawuba noted that its performance reflects “disciplined execution of strategic goals, focusing on balance sheet expansion, transaction banking, and digital banking businesses across our markets.”

According to him, the bank’s Profit Before Tax (PBT) rose to N401.6 billion, a reflection of its ability to manage risks effectively despite macroeconomic challenges.

He added that customer deposit surged by 34 per cent from N17.4 trillion at year-end 2023 to N23.2 trillion in H1 2024, a sign of trust and loyalty of their customers.

The bank’s total Assets grew by 37 per cent growth from N20.7 trillion in 2023 to N28.3 trillion in H1 2024. “This growth was driven by strong customer relationships and our ability to capitalize on opportunities across geographies,” Alawuba clarified. The bank achieved a net interest income growth of 143 per cent year-on-year to N675 billion, further underscoring the strength of its core banking operations.

Digital Banking & Payments Growth

Further breakdown showed that UBA’s digital banking income surged by 107.8 per cent year-on-year to N106 billion, while funds transfer and remittance fees rose by 188.7 per cent and 228 per cent, respectively.

“We continue to lead in digital banking and payment solutions, helping drive financial inclusion across Africa,” he stated.

The bank’s Income from trade transactions grew by 83 per cent to N18 billion within the period under review, highlighting its increasing role in facilitating intra-regional and international trade.

The further stated that the bank’s investment in technology, innovation, and data analytics has continued to yield significant returns, positioning it as a leader in digital transformation.

The GMD also said strategic partnerships remain central to the bank’s growth strategy, adding that UBA was one of six banks to partner with the Pan-African Payment Settlement System (PAPSS) in 2024, aimed at enhancing cross-border trade and financial integration across Africa.

READ ALSO: Economic Downturn: Is UBA Your Trusted Bank For Investments?

He added that bank has expanded collaborations with telecommunications companies, with funds under management now exceeding $1 billion. “These partnerships enable us to deliver impactful solutions such as micro-lending and savings products, enhancing financial inclusion,” he emphasised.

UBA ESG and Achievements

He said UBA is committed to its Environmental, Social, and Governance (ESG) responsibilities, adding that the bank has pledged to plant one million trees over the next one year and will continue to rollout Braille account opening packages to more countries, promoting inclusivity for visually impaired customers.

“Our loans to young entrepreneurs, women-led businesses, and SMEs across Africa are part of our broader commitment to driving inclusive growth,” he stated.

UBA’s achievements, according to the GMD, have been recognized through multiple awards including Global Finance’s Best Bank in Frontier Markets and Best SME Bank in Africa. These accolades affirm the bank’s commitment to excellence and delivering sustainable growth across markets.

Recapitalisation plans

Speaking on recapitalisation process, Alawuba said the bank has gotten to an advanced stage, adding that an application has been submitted to the Securities and Exchange Commission (SEC) and their approval is expected in the next couple of weeks.

In his closing remarks, Alawuba said the successes recorded in the H1 2024 were made possible by the dedication of the bank’s employees, customers’ trust, support of regulators, and the confidence of their shareholders. “We remain committed to achieving even greater milestones with your continued support,” he added.