South African retail giant Shoprite Holdings has announced its decision to exit both Ghana and Malawi, marking another step in its ongoing retreat from several African markets as it refocuses operations on its core South African business.

The company, Africa’s largest food retailer, confirmed that it had signed agreements to divest its operations in the two countries.

Join our WhatsApp ChannelIn Malawi, Shoprite has agreed to sell its five trading stores, while in Ghana, the group said it had received a binding offer for seven stores and one warehouse. Both transactions are pending regulatory approvals.

According to the group’s operational update, the Malawian sale agreement was signed on 6 June 2025 and is subject to clearance by the Competition and Fair Trading Commission and the Reserve Bank of Malawi. The deal in Ghana, described by the company as “highly probable,” also awaits final approval.

A Broader Exit from Africa

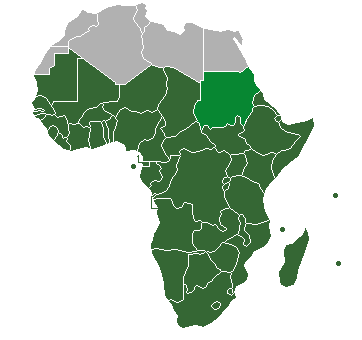

Shoprite’s move to exit Ghana and Malawi forms part of a broader strategy that has seen the company withdraw from several other African countries in recent years. These include Nigeria, Kenya, Uganda, Madagascar, the Democratic Republic of the Congo, and Angola.

The company has cited numerous challenges across these markets, including currency instability, high inflation, import dependence, and rentals pegged to the US dollar, which have made operations increasingly difficult and unprofitable.

READ ALSO: Shoprite Nigeria Closes Kano Store, Mulls 5-year Bullish Growth For Nigerian Market

In Ghana, for instance, Shoprite had previously reported losses stemming from the volatile exchange rate and import duties on goods, which impacted its ability to maintain profit margins. Similar issues have persisted in Malawi, where shortages of foreign currency have severely limited import capacity and disrupted the retail supply chain.

Market Reaction and Financial Outlook

News of the dual exit triggered a 2.6% drop in Shoprite’s share price on the Johannesburg Stock Exchange on Monday, reflecting investor concern about the retailer’s shrinking footprint outside South Africa.

Despite these developments, Shoprite remains optimistic about its financial performance. The group expects headline earnings per share to rise between 9.4% and 19.4% for the 52 weeks ending 29 June 2025, compared to the previous year. Sales from continuing operations are forecast to increase by 8.9%, reaching approximately $14 billion.

The company has reiterated that its future investment strategy will favour markets where it has more operational control and less exposure to economic volatility.

Shoprite’s retrenchment from African markets began in earnest in 2020, when it announced its decision to exit Nigeria after 15 years. Since then, the retailer has either sold or scaled down operations in more than half a dozen countries on the continent. Company executives have said the move is necessary to ensure sustainable growth and efficient capital allocation.

If approvals proceed as planned, Shoprite is expected to complete its exits from Ghana and Malawi by the end of 2025, bringing to a close its decades-long presence in both countries.