The United States Dollar (USD) gained against the Naira in the black market on Thursday, 2 March 2023, as the exchange rate appreciated by 1.05 per cent.

During trading in the Bureau De Change window of the black market, the exchange rate went up by 1.05 per cent, as $1 traded at an average of N768, against the N760/$1 both currencies exchanged for on Wednesday, 1 March 2023.

Join our WhatsApp ChannelIn the official market, the exchange rate between the Naira and the Dollar closed at N461.35 on Wednesday, in contrast to the N462/$1 that was reported on Tuesday, 28 February 2023.

This indicates Naira appreciated by 0.14 per cent in the window backed by the Central Bank of Nigeria (CBN) or N0.65 kobo decline in the cost of a Dollar.

According to the exchange rate data obtained from the FMDQ Securities, before the value of one Dollar settled at N461.35 kobo, the rate had hit a high of N462.50/$1 and a low of N446.

It was gathered that the value of foreign exchange (Forex) traded in the Investors’ and Exporters’ window of the official market on Wednesday was $98.6 million.

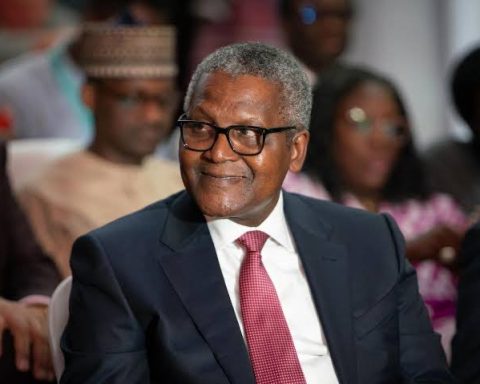

The appreciation of the Dollar in the black market and the Naira in the official market followed the announcement of Bola Tinubu as the winner of the Presidential election in Nigeria.

What Tinubu’s victory mean for the forex market

Prime Business Africa understands that Tinubu’s plan for the forex market is to bring down the official market rate to N300/$1 in a short term, with his long-term goal being N200/$1.

In his economic manifesto, Tinubu said he will work with the central bank to stabilise the Naira against the Dollar. The Nigerian currency weakened by 7.96 per cent in 2022 due to certain monetary policies of the CBN.

But Tinubu is hopeful that his government’s fiscal policies, when integrated with the CBN’s monetary policies will halt the further depreciation of the Naira in the official market.

“My administration will collaborate with the Central Bank to harmonize the fiscal and monetary policy to achieve immediate stabilization of the value of the naira against the US dollars and other currencies and in the short term, strengthen the naira by boosting the supply of foreign currency and moderating demand.

“The short-term goal is to achieve a naira/dollar rate of 300 naira/US$ and gradually achieve a less than 200 naira rate over the next four years,” he assured.

Tinubu’s win at the poll signals an end to multiple exchange rates if his campaign promise is to go by, “When I become president, multiple exchange rates will go away. Write it down,” he said in December 2022.

Nigeria operates several exchange rates, from Nigerian Autonomous Foreign Exchange Rate Fixing (NAFEX), also called the Investors and Exporters (I&E) to the Bureau De Change (BDC) window in the black market and the International Air Transport Association (IATA) rate.

The World Bank and the International Monetary Fund (IMF) have frowned against the multiple rates, urging the CBN to do away with them and adopt a single market – although the central bank has leaned more towards the NAFEX window.