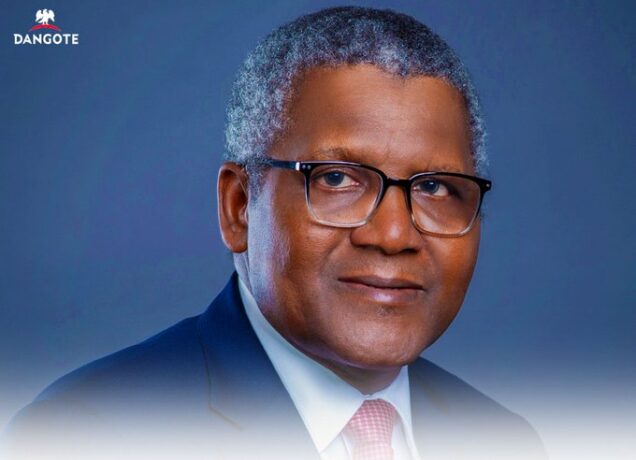

The perennial rivalry between Nigeria’s richest man, Aliko Dangote, and South Africa’s richest, Johann Rupert, over who stays at the top spot of the number one Wealthiest African ranking, resurrected again last week Tuesday, 27th August 2024.

According to the Forbes and Bloomberg daily rankings of global wealthiest, Aliko Dangote, the Nigerian billionaire and head of Dangote Group, lost his number one title as Africa’s richest man to South African luxury goods magnate Johann Rupert on that day.

Join our WhatsApp ChannelThe report indicated that as of Tuesday 27th August 2024, Dangote global wealth ranking by Forbes declined to 186th with a net worth of $11.4 billion compared to Rupert who chairs the Swiss luxury goods company, Richemont, with net worth at $11.9 billion and ranked 175th globally.

READ ALSO: Forbes List: Dangote Reclaims Richest African Title From South Africa’s Johann Rupert

In the same vein, the Bloomberg Billionaires Index places Rupert at 146th worldwide with a net worth of $14.3 billion, while Dangote is ranked 160th with $13.4 billion and by the same token, lost the number one spot to Rupert in the Bloomberg African wealth ranking.

However, the crux of the matter in this race to the top of the Africa’s wealthiest between these two very rich is the value of the respective national currencies of the two rich men. Dangote lost the number one spot because of a $486million depreciation in the value of the Naira between Friday 23 August 2024 and Tuesday 27 August 2024.

The naira-dollar exchange rate on the official market on Tuesday, 27th August 2024 closed at N1,589 from a N1,578 close on Friday, 23rd August 2024. The N11 loss in the value of the Naira within three trading days was what added up to the equivalent of $486million loss position in Dangote’s networth and thus, pushed Rupert through to the number one spot.

Even now, the continued diminishing value of the naira bode ill not only for Dangote, but for all the very rich and, indeed, the larger Nigerian economy. This is exemplified by the fact that two days after Dangote lost the sum of $486million, the Naira further depreciated to N1,593 on Thursday, 29th August 2024. This is indicative of the high rate of depreciation of the Naira in foreign exchange transactions.

The more disconcerting concern is that with the naira depreciating geometrically as it appears to be doing since June 2023, its value in savings and transactional worth also get eroded. On account of this, I can predict again, as i did predict in the course of the year of this circumstances with Dangote, that if things go on as presently, no Nigerian rich will be counted in the first 10 in the rank of Africa’s richest. What is obvious is that at the end of the day, every economic agent will become the loser in this unpredictable foreign exchange environment. This needs to be corrected.

Once again, I call on the Federal Government and the community of Nigeria’s very rich, who themselves are by this economically excruciating exchange rate devaluation, victims of value erosion, to set, urgently, an agenda for reviving the worth of the Naira. It is the only way to redeeming our national economic standing and taking back our national pride.

Nze Chidi Duru, Chairman, Grand Towers Nze Chidi Duru, OON Founder/Chairman, Grand Towers Limited & Callphone Limited