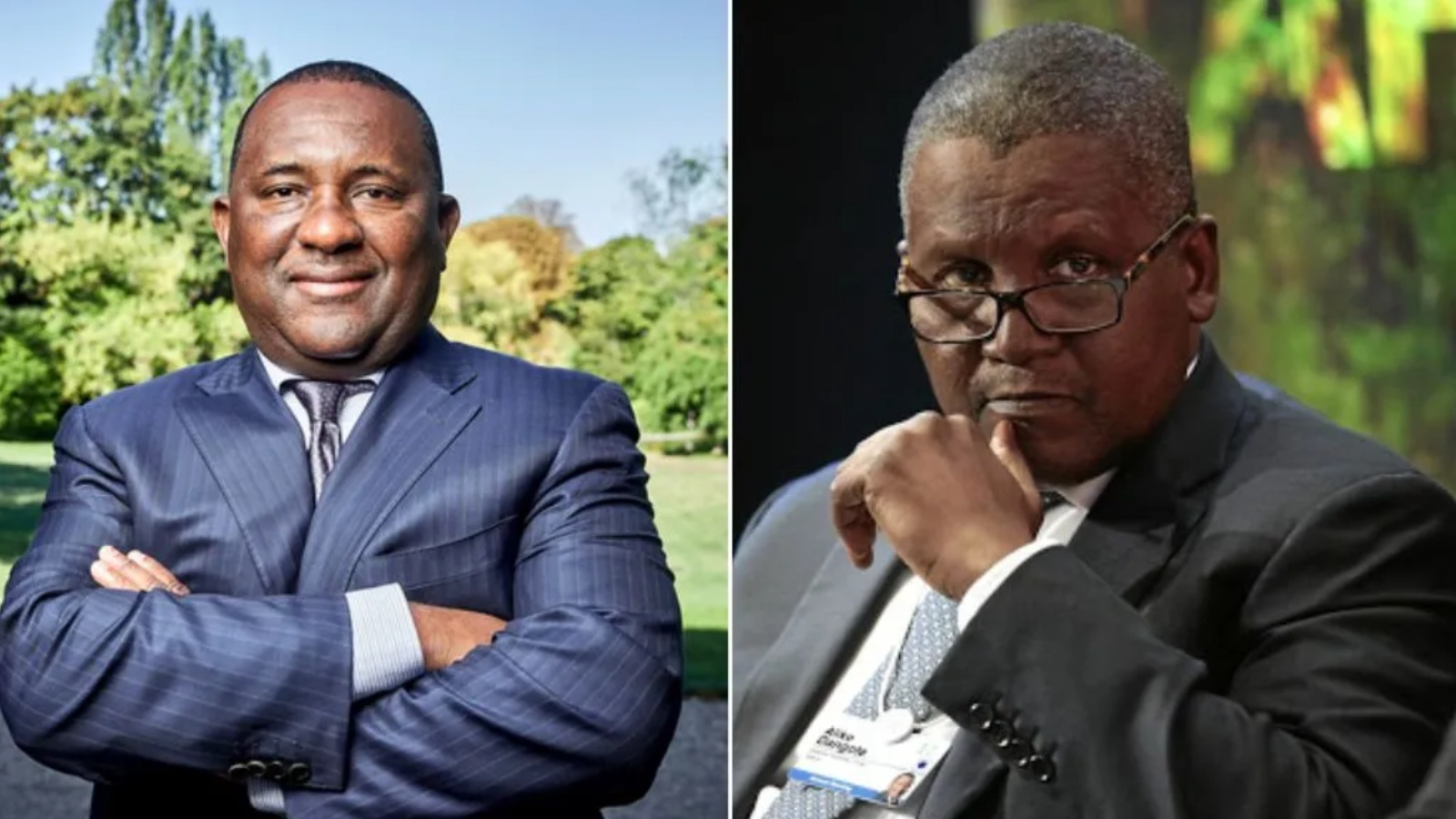

Abdul Samad Rabiu, the founder and chairman of BUA Cement, outearned his market rival, Aliko Dangote, the founder and chairman of Dangote Cement, by N670.28 billion in the third quarter (Q3) of 2025.

According to Prime Business Africa’s analysis, BUA Cement’s share price had skyrocketed from N95.40 kobo on July 1 to N160 on September 30, indicating equity traders on the Nigerian Exchange (NGX) Limited were willing to pay N64.6 kobo more by the end of Q3.

Join our WhatsApp ChannelThis led to Rabiu’s investment value in BUA Cement rising by 67.71 percent, resulting in a gain of N2.13 trillion for the billionaire within the three months under review.

Rabiu recorded the N2.13 trillion gain due to the 33.07 billion direct and indirect shares he holds in the cement manufacturer as of June 2025, which represents a 97.66 percent controlling stake.

The businessman’s shares in BUA Cement are split into three: direct shares of 18.97 billion, representing 56.03 percent; another direct share of 637.40 million, representing 1.88; and indirect shares of 13.46 billion, held through BUA Industries Limited, representing 39.75 percent.

Prime Business Africa’s analysis showed that the 33.07 billion shares held by Rabiu were valued at N3.15 trillion at the start of July; however, due to the N64.6 kobo increase in BUA’s share price, the value of the billionaire’s shares closed September at N5.29 trillion.

Also, Dangote Cement recorded a significant growth in its investment value, which increased by 23.55 percent, representing a gain of N1.46 trillion during the period under review.

The gain was driven by a surge in demand for the company’s shares, which resulted in the share price rising from N425 on July 1 to N525.10 kobo on September 30, reflecting a N100.1 kobo appreciation.

This increased Dangote’s net worth in the cement business from N6.22 trillion to N7.69 trillion from the start of the third quarter to the end of the period.

Dangote’s net worth is drawn from his 14.64 billion direct and indirect shares held in Dangote Cement, split into 14.62 billion indirect shares, held through Dangote Industries Ltd and representing 87.28 percent, and 27,64 million direct shares, representing 0.17 percent.

For press releases, tip-offs, and corporate information, call 08149575257 (hotline)

Email: editor@primebusiness.africa, publisher@primebusiness.africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa

- Prime Business Africa