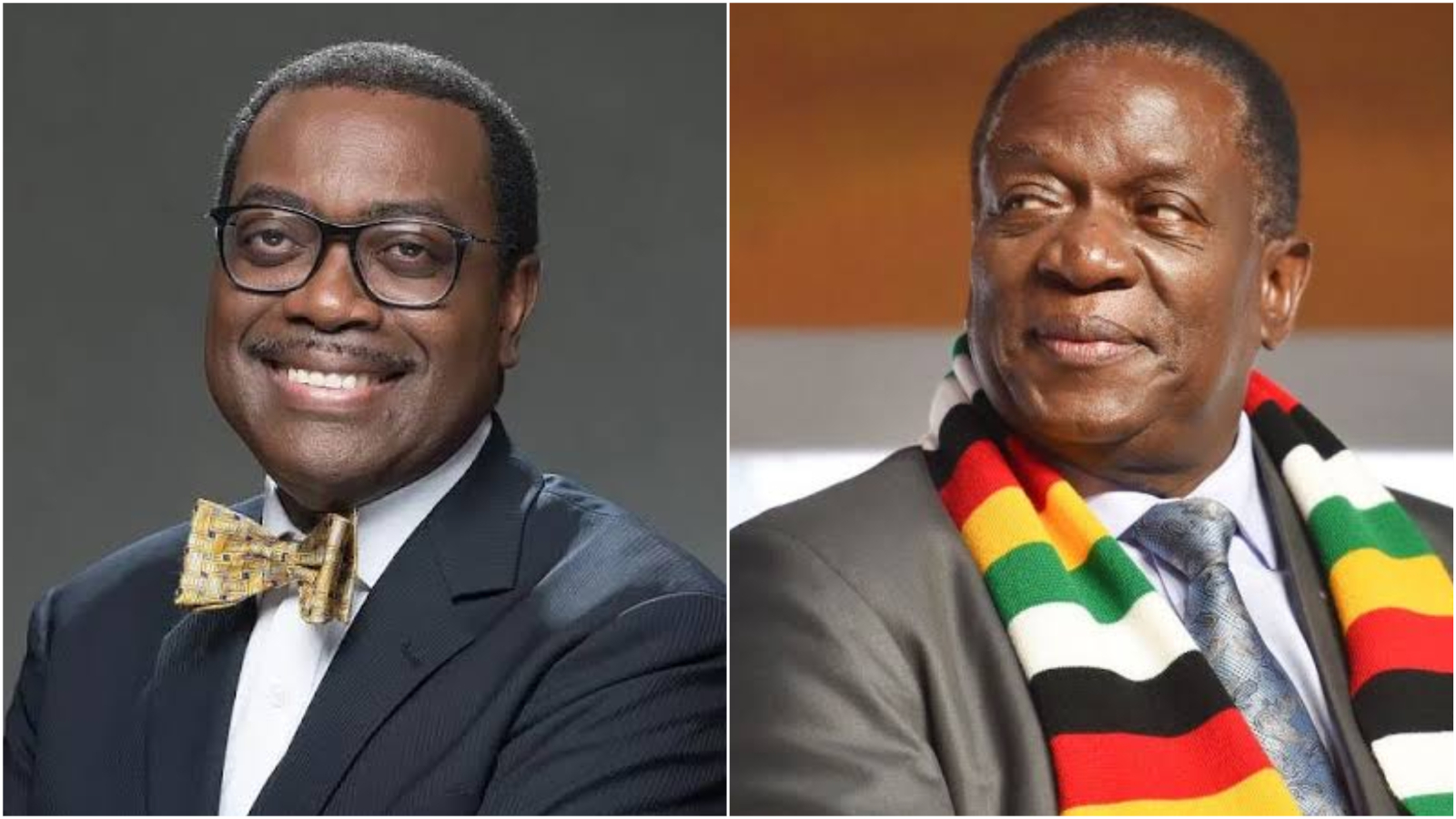

Zimbabwean government will meet with Nigerian economist and African Development Bank (AfDB) Group president, Akinwumi Adesina, to discuss solutions to its economy downturn and debt problem.

The problem with Zimbabwe?

The country has been struggling with soaring inflation rate of 191%, that has eroded the value on the Zimbabwean currency, Zim Dollar. The economic crisis has forced the government to do away with its legal tender and embrace gold coins and American dollar as alternative.

Join our WhatsApp ChannelRipple effect from the collapse of the economy has led to reports that some citizens of the country are selling their toes between $20,000 to $40,000, in order to survive the economy.

The country’s financial situation saw multilateral financial institutions, including AfDB, sanction Zimbabwe over $2.6 billion debt arrears.

What Akinwumi Adesina will do for Zimbabwe?

With the Zimbabwean government unable to get the country out of the economic downturn, its President, Emmerson Mnangagwa, appointed Adesina as its arrears clearance and debt resolution adviser in February.

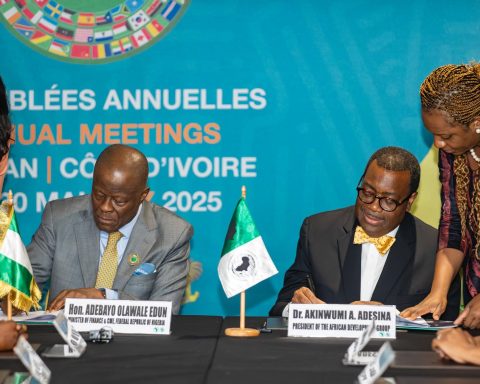

Adesina is now in the country for a two-day official visit to meet President Mnangagwa and his Finance and Economic Development Minister, Mthuli Ncube, to sort out various issues, which covers AfDB’s technical assistance for Zimbabwean government.

Already, AfDB has been managing the $145.8 million Zimbabwe Multi-Donor Trust Fund (ZimFund) funded by United Kingdom, Germany, Norway, Sweden, Switzerland, Australia, as well as Denmark.

Withdrawal from the ZimFund has been under the oversight of AfDB since 2010, and the capital has mostly been used for water, sanitation infrastructure, and energy.

With Adesina now acting as Zimbabwe’s arrears clearance and debt resolution adviser, he will also meet with representatives of international financial institutions that have extended credit to Zimbabwe.

Part of his to-do list includes sitting with representatives of African nations and the G7 countries; Canada, France, Germany, Italy, Japan, the United Kingdom and the United States, on behalf of Zimbabwe government.