Wema Bank has announced plans to borrow N25 billion through bond issuance, a corporate document dated 2 March 2023 has revealed.

The financial institution said part of the fund will be disbursed as credit to Nigeria’s Small and Medium Enterprise (SME) businesses in the retail and commercial space.

Join our WhatsApp ChannelPrime Business Africa learnt that the bond will not be listed on the Security Exchange or Capital market, as Wema Bank is targeting certain investors to provide the funds in private.

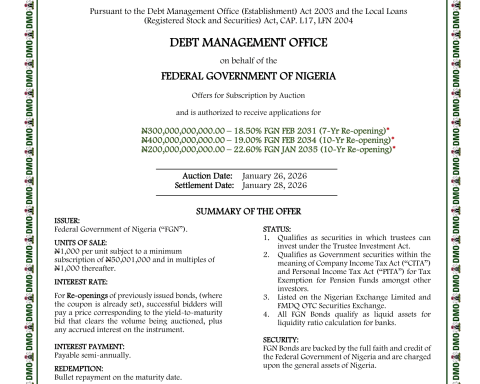

The N25 billion bond will be issued under a Perpetual Fixed Rate Non-Resettable Additional Tier 1 Subordinated Bonds.

What Wema Bank is saying:

Part of the document reads: “The Bank is proposing the issuance of Perpetual Fixed Rate Non-Resettable Additional Tier 1 Subordinated Bonds (hereinafter referred to as “the bonds”) with loss absorption features totaling about N25 billion to targeted investors. The Bonds are being issued privately to targeted investors and will not be listed on any Security Exchange

“Wema Bank Plc decided on the bonds issuance as a means of shoring up its capital base to facilitate the bank’s business of lending to the Nigerian Small and Medium Enterprise (SME) businesses alongside deepening the bank’s loan portfolio in the retail and commercial lending space.

“In addition, the Additional Tier 1 bonds issuance would aid the bank in its digital dominance goal through improvements in our information technology infrastructures.

“The bonds will be issued in a dematerialized form under a trust deed in denominations of NGN1,000.00 with a minimum acceptable subscription of NGN1,000,000,000.00 (1 Billion Naira) with an interest rate of 16%.

“Furthermore, the bonds are perpetual in nature (with maturity linked to the corporate duration of Wema Bank Plc as a going concern) and may be called by the issuer at its sole option and after giving a minimum of 20 days and a maximum of 60 days to the Bondholders and Bonds Trustee subject to the relevant regulatory approvals.”