Value Added Tax (VAT) collection in Nigeria has experienced significant improvement over the years. Currently one of Nigeria’s main sources of revenue, aside from oil, VAT which is managed by the Federal Inland Revenue Service (FIRS), is a consumption tax levied on the supply of goods and services.

With changes in the economy globally, and the need to shore up the dwindling revenue, the Nigerian government increased the VAT rate from 5 per cent to 7.5 per cent in February 2020.

Join our WhatsApp ChannelReports so far indicate a significant improvement in VAT collection across the country. While some sectors emerge top contributors, others score very low reflecting challenges in the business environment in the country.

Analysts said the improvement in VAT collection recorded in recent times could be as a result of improved compliance, effectiveness of enforcement measures, effect of the increased rate and level of economic activities in the country.

According to data released by the National Bureau of Statistics (NBS), Nigeria recorded an increase of 45.02 per cent in VAT from N2.51 trillion in 2022 to N3.64 trillion in 2023. That of 2022 was a 21.2 per cent increase compared to N2.07 trillion recorded in the previous year.

In this article, we will highlight the top five sectors that recorded the highest VAT contributions to Nigeria’s economy in 2023.

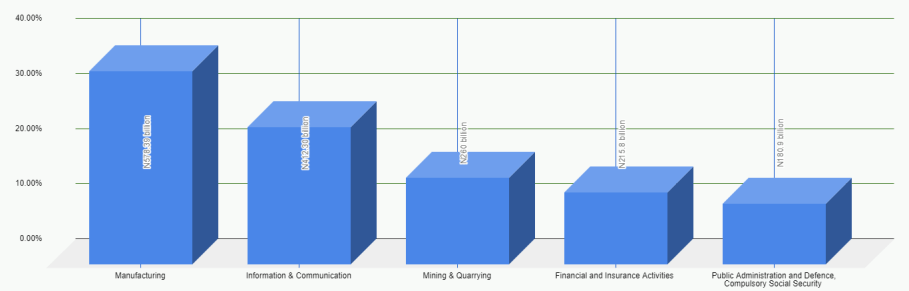

These sectors include Manufacturing, Information and Communication, Mining and Quarrying, Financial and Insurance activities, and Public Administration and Defence, Compulsory Social Security.

1. Manufacturing

Manufacturing had the highest VAT contribution among all the sectors reported as it recorded a total sum of N578.39 billion in the four quarters of 2023.

This was a 21 per cent increase from N477.4 billion in 2022. This performance is despite the challenges in the manufacturing sector such as high energy costs and other input costs, deficit infrastructure, and supply chain disruptions.

As Nigeria battles surging inflation and high exchange rates, experts have repeatedly emphasised the need to boost production to curb the volume of imports and increase exports for forex earnings that would boost the value of the naira, as a way of solving the problem. This can only be achieved by increasing investments and boosting activities in the manufacturing sector.

2. Information and Communication

The NBS data revealed that VAT payments in the information and communication sector in 2023 is N412.30 billion reflecting a significant increase of 53 per cent from N268.8 billion in 2022. The sector, according to NBS, consists of Telecommunications and Info Companies; Publishing; Movement Image, Sound Recording and Music Manufacturing; and Broadcasting. The sector has shown rapid progress in recent years largely driven by activities in the telecommunications sub-sector which contributed 14 per cent to the GDP in the real term. Generally, ICT sector contributed 16.66 per cent.

READ ALSO: Nigeria’s VAT Collections Increase By 72.12% YoY Record N1.20trn In Q4 2023

3. Mining and Quarrying

The Mining and Quarrying sector’s VAT contributions surged by 64 percent, from N158.5 billion in 2022 to N260 billion in 2023.

Apart from crude oil which has been the major source of revenue to the Federal Government for decades, there has been an increased focus on the mining of solid minerals across the country in recent times given the urgent need for diversification of the economy.

While mining has the potential to significantly contribute to Nigeria’s economic development, the sector’s numerous challenges have hindered that. Some of them, according to a report by Mining Review Africa, include regulatory and legal challenges, infrastructure deficits, security challenges, and environmental and social concerns.

These need to be addressed for optimal growth of the sector.

4. Financial and Insurance Activities

The VAT contributions made by the Financial and Insurance Activities sector increased by 98 per cent, from N109.3 billion in 2022 to N215.8 billion in 2023, almost doubling in size.

The integration of fintech, cyber security threats, and regulatory compliance cast a shadow over the sector’s rise.

5. Public Administration and Defence, Compulsory Social Security

The VAT contributions for this sector increased by 41 per cent between 2022 and 2023, from N128.7 billion to N180.9 billion.

Although this suggests a rise in government expenditure and activity, the industry is nevertheless plagued by problems with bureaucratic inefficiency and governance that require improvement.