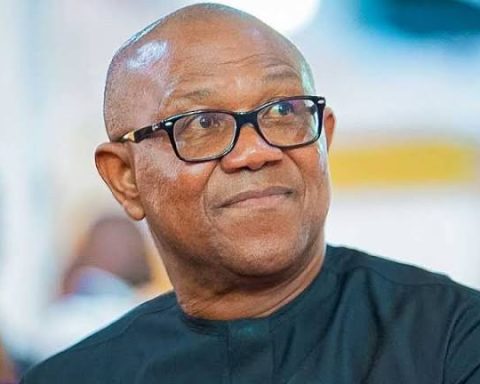

The Presidential candidate of the Labour Party, Peter Obi, has addressed the controversy surrounding his company, Next International (UK) Limited.

According to a report by Premium Times, Next was shut down by the UK authorities for failing to submit the company’s account statements as required by law.

Join our WhatsApp ChannelNext International, which was incorporated on May 16, 1996, failed to submit its annual statements for four consecutive years, starting from 2017 to 2020.

Each year, the UK’s Companies House, the executive agency of the British Government that maintains the register of companies, had to remind Next to submit its financials through a first gazette notice of a “compulsory” strike off.

The first gazette notifies companies to submit their financials, a second gazette usually leads to the company being struck off or shut down by the UK authorities.

In September 2021, Next was reportedly dissolved by the UK government after a first and second gazette notice of “compulsory” strike-off was issued to the company.

Responding to the report, Obi, through a statement released by his party on Thursday, stated that he was no longer in charge of the UK subsidiary, which is owned 99 per cent by Next Nigeria International Ltd, also owned by Obi.

It was gathered that after Obi became governor of Anambra State in 2006, his wife took charge of the firm, which later became unoperational.

The statement reads that Next UK started the process to be dissolved under the voluntary strike off: “For the record, the entity was 99% owned by Next Nigeria International Ltd., and established as its buying office in the 90s and Peter Obi was its CEO.

“At the time Peter Obi became governor of Anambra State in 2006, his wife assumed management of the winding down of the company and about one year ago, requested that the company be dissolved under the voluntary strike off of the entity on grounds of dissolution and being inoperational, which is normal in winding up an entity.

“Peter Obi has consistently maintained that he is no longer involved in any Next related business,” the statement said.

The statement signed by Head of the Obi-Datti Media Office, Diran Onifade, added: “When our Principal insists that you go and verify facts about him and the information he dishes out, it didn’t say go and falsify facts.

“The LP candidate by his antecedents in Anambra State for eight years, in private ventures where he held sway his records among the pack in this race for the Presidency, puts him miles ahead in moral rating”