In a market day marked by red numbers, the Nigerian Exchange (NGX) showcased its resilience as it closed in negative territory on Thursday. Despite equities declining further amid high trading volume, market players found glimmers of hope in the midst of the downturn.

The Nigerian Exchange (NGX) closed in the red on Thursday, with the All-Share Index (ASI) slipping 0.09% lower, closing at 68,271.14 index points. While the market capitalization of equities lost N35 billion, closing at N37.365 trillion, investors found some solace in the market’s underlying resilience.

Join our WhatsApp ChannelDespite the overall dip, certain stocks stood out in this challenging environment. JOHNHOLT surged by 9.55%, leading the gainers, while OANDO struggled, posting a significant loss of 9.93%. UNIVINSURE was the most traded equity by volume.

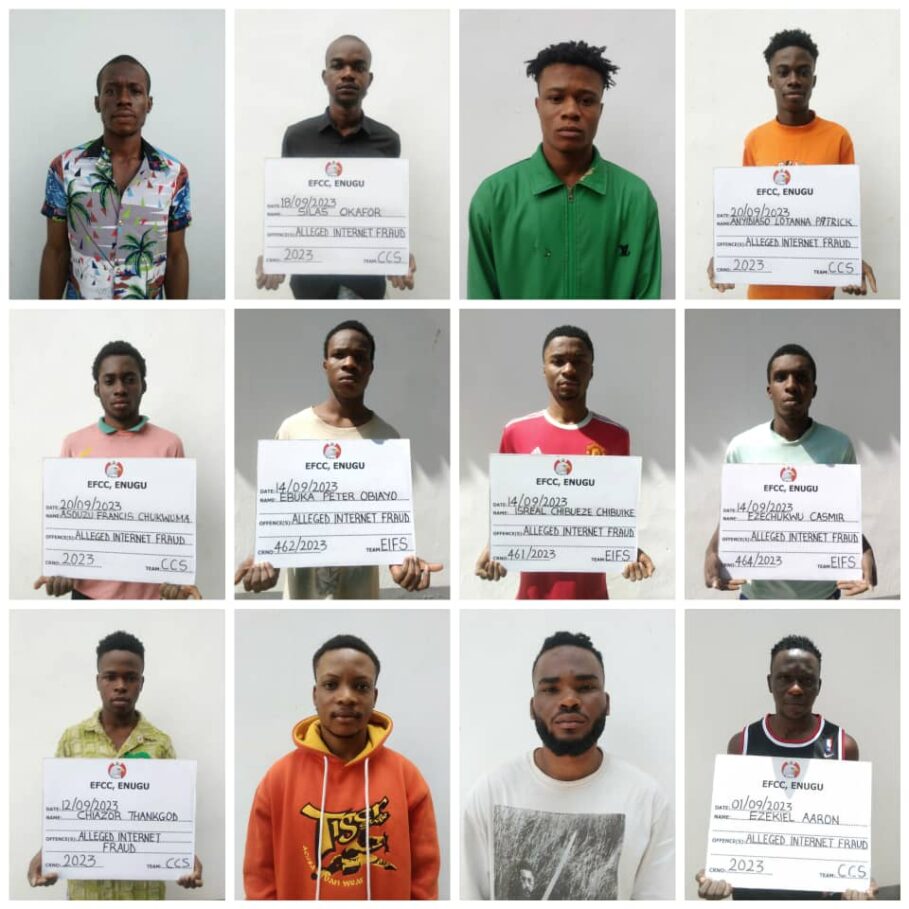

READ ALSO: 28 ‘Yahoo Boys’ Convicted For Internet Fraud In Anambra Crackdown

The top gainers included JOHNHOLT, OMATEK, and DAAR COMMUNICATIONS, all posting impressive gains. Conversely, OANDO, LASACO, and CHAMS led the top losers’ chart.

Trading activity saw a significant uptick in volume, with 1.12 billion units of shares changing hands. UNIVINSURE led the volume chart, with 669.01 million units traded. OANDO, however, led in terms of value traded.

Shares worth over one trillion (swoot) displayed mixed results, with ZENITH BANK and GTCO posting positive sessions, while MTN NIGERIA closed in the negative. Several major stocks remained flat.

Tier 1 banks experienced mixed trading sessions, with UBA, ACCESS HOLDINGS, and FBN HOLDINGS recording losses, while ZENITH BANK and GTCO closed positively, showing varied performance within the banking sector.

Emmanuel Ochayi is a journalist. He is a graduate of the University of Lagos, School of first choice and the nations pride. Emmanuel is keen on exploring writing angles in different areas, including Business, climate change, politics, Education, and others.