NNPCL Fuel Prices Ignite Controversy

The Nigerian National Petroleum Company Limited (NNPCL) has come under fire for asking independent oil marketers to purchase fuel at higher prices than what it paid for the product from the Dangote Refinery. Marketers are now calling for refunds, sparking nationwide concern over fuel pricing and availability.

The National President of the Independent Marketers Association of Nigeria (IPMAN), Abubakar Garima, disclosed in an interview on Channels TV’s Sunrise Daily that NNPCL is asking marketers to buy fuel at N1,010 per litre in Lagos. This price is notably higher than what NNPCL paid for the product, which Garima stated was between N800 and N900 per litre from Dangote Refinery.

Join our WhatsApp ChannelGarima explained, “NNPCL purchased fuel at a lower price, but they are now selling to us at N1,010 per litre in Lagos, N1,045 in Calabar, N1,050 in Port Harcourt, and N1,040 in Warri. We believe this is unreasonable, and we have asked them to either reduce the price or refund our money.”

Fuel Price Hike Shocks Nigerians

The NNPCL recently increased fuel prices across its retail stations, raising the price in Abuja from N897 to N1,030 per litre and in Lagos from N868 to N998 per litre. Other cities have also seen price hikes, sparking public outrage. This marks the second price increase in one month, with a sharp 14.8% rise in fuel costs.

For many Nigerians, the expectation of cheaper fuel prices has not been met, despite the commencement of crude-for-naira sales. Instead, fuel prices have skyrocketed, rising by over 430% since the current administration took office in May 2023.

Garima addressed these concerns, noting, “We cannot call this an increase anymore. This is full deregulation, and the effects are now being felt. However, NNPCL’s actions are putting an additional burden on marketers, and by extension, the public.”

Marketers Demand Direct Dealings with Dangote Refinery

Independent marketers have expressed frustration with the current arrangement, as they are forced to buy from NNPCL at inflated prices. Garima explained that marketers had already paid NNPCL for fuel before the latest price hike. Now, they are demanding that NNPCL either sell the product to them at the same price it purchased from Dangote or return their money so that marketers can buy directly from the refinery.

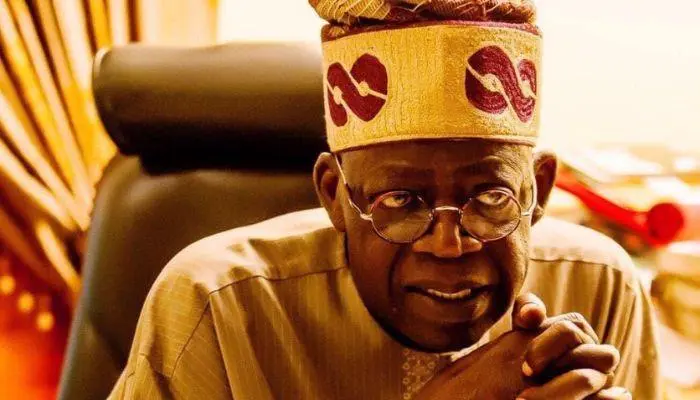

READ ALSO: US-based Nigerian Professor Berates NNPCL For Poor Treatment Of Workers, Urges Tinubu To Intervene

Garima stated, “We have booked products through NNPCL, but with this sudden increase, we are now being asked to pay more. This situation has been ongoing for three months, with NNPCL holding onto our money.”

He continued, “Our request is simple: either sell the product to us at Dangote’s price or return our money. We want to buy directly from Dangote Refinery. We are not asking for anything more than fairness.”

NNPCL Owes Marketers N15 Billion

The tension between NNPCL and independent marketers has been exacerbated by outstanding debts. According to Garima, NNPCL owes marketers nearly N15 billion for previous transactions. This debt has created further challenges for the marketers, who are struggling to continue their operations under the current conditions.

“NNPCL has been importing and distributing fuel, but they still owe us about N15 billion,” Garima revealed. “We want to be fully involved in the business of petroleum distribution. The current system isn’t sustainable for us.”

Future of Fuel Distribution in Nigeria

The ongoing dispute between NNPCL and independent marketers highlights broader concerns about Nigeria’s fuel pricing system and the impact of deregulation. As marketers push for more direct involvement in fuel procurement and distribution, the country’s fuel market may face significant changes.

Garima emphasised that independent marketers are ready to handle direct imports and purchases from Dangote Refinery, but they need to be allowed a fair and transparent process.

“We are not opposed to deregulation,” Garima said. “But we need a fair system that doesn’t favour NNPCL over other marketers. This current situation, where NNPCL buys at a lower price and sells to us at a higher price, cannot continue.”

As negotiations continue, Nigerians are left grappling with rising fuel prices and uncertain futures in the fuel market. Whether the marketers’ demands will be met remains to be seen, but the pressure on NNPCL is building, with public patience wearing thin.