Prosper Okoye

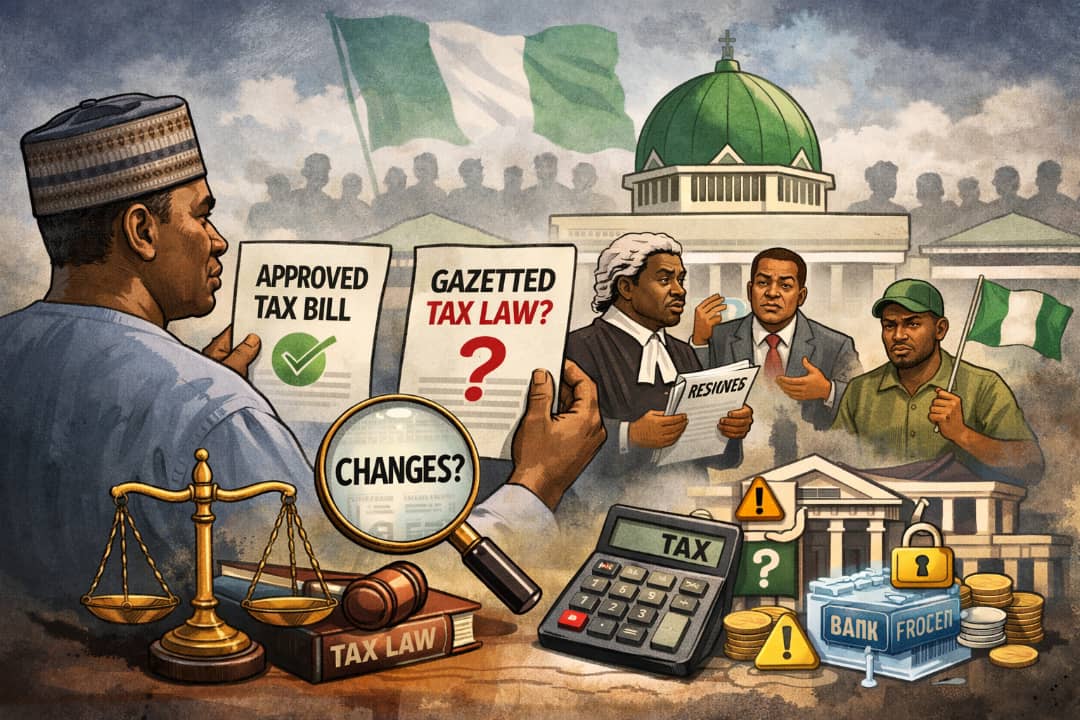

Nigeria’s new tax laws were meant to clear confusion from the country’s complex tax system. Instead, they have created a different kind of uncertainty — about whether the laws being prepared for implementation are exactly what the National Assembly passed.

That allegation has prompted responses from lawyers, politicians, tax experts, and government officials, turning what began as a policy reform into a test of trust in Nigeria’s lawmaking process.

Join our WhatsApp ChannelWhere the Concern Began

Abdulsamad Dasuki, a member of the House of Representatives from Sokoto State, raised an alarm about the new tax laws. He said the versions published in the government gazette were different from the bills approved by parliament.

In Nigeria’s constitutional system, this is a serious matter. Once lawmakers pass a bill and the president signs it, the content is not supposed to change. Publishing the law is meant to be a formal step, not an opportunity for alteration.

The issue also has a wider context. During the legislative process, several northern political and civic groups openly opposed parts of the tax reform bills, arguing they could disproportionately disadvantage the region. Northern state governors, traditional leadership forums, and civil society organisations raised concerns about revenue distribution and consultation. At the same time, other groups from the north supported the reforms, showing that opinions within the region were not uniform.

Some observers note that the reforms were initially seen as less favourable to northern states. The fact that a northern lawmaker has now raised questions about the gazettement of the bills has drawn attention, with some wondering whether this reflects regional interests or a broader concern for transparency in the legislative process.

Why Lawyers Are Asking For a Pause

The Nigerian Bar Association (NBA) responded swiftly, describing the allegations of alterations to the tax laws as a threat to the credibility of the legislative process. The lawyers’ body did not oppose the tax reforms themselves. Instead, it focused on the process by which the laws became official.

The NBA called for the suspension of implementation until a transparent investigation clarifies whether any changes were made after parliamentary approval.

In its warning, the association pointed to wider consequences. Legal uncertainty, it said, can unsettle businesses, weaken investor confidence, and create confusion for individuals and institutions expected to comply with the law.

To the average taxpayer, the dispute may sound distant or technical. But uncertainty over how a law came into force can have real effects.

Businesses planning for the future need clarity about the rules they will operate under. Investors look closely at how reliably laws are made and applied. And citizens need confidence that their rights and obligations are clearly defined.

If doubts persist, courts may later be asked to intervene — potentially delaying or overturning parts of the reforms.

What the Government Says the Reforms Are Meant to Do

The Federal Government insists the reforms are sound and long overdue, noting that the new tax laws aim to simplify tax collection, reduce multiple taxation, improve revenue generation, and make Nigeria more attractive for investment.

The reforms involve four major laws, each addressing a different aspect of Nigeria’s tax system:

Nigeria Tax Act, 2025 – This is the main law that consolidates multiple previous tax laws into a single framework. It broadens the tax base, introduces modern provisions for digital services, and requires certain large companies to meet a global minimum effective tax rate. It also removes overlapping levies, aiming to make the system simpler and fairer for businesses and individuals.

Nigeria Tax Administration Act, 2025 – This law sets out uniform rules for how taxes are registered, assessed, collected, and enforced. It introduces mandatory electronic filing and reporting, replacing the patchwork of procedures that varied by tax type and region.

Nigeria Revenue Service (Establishment) Act, 2025 – This transforms the Federal Inland Revenue Service (FIRS) into a more autonomous and performance-driven Nigeria Revenue Service (NRS). The agency now has a new governance structure, greater operational autonomy, and the power to conduct joint audits with state and local revenue authorities.

Joint Revenue Board (Establishment) Act, 2025 – This creates the Joint Revenue Board to coordinate tax matters across federal, state, and local governments. It also establishes a Tax Appeal Tribunal and an Office of the Tax Ombudsman, providing better protection for taxpayers and ensuring disputes are resolved fairly.

According to officials, these reforms mark a significant departure from the old system. Previously, Nigeria’s tax laws were fragmented, administered by multiple agencies, and often inconsistent. The new framework is designed to unify administration, reduce confusion, and improve compliance while protecting lower-income households.

The chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, has described the laws as laying a foundation rather than completing the work. He has repeatedly stressed that the reforms are not intended to increase the burden on ordinary Nigerians. Under the new system, households earning ₦250,000 or less per month are classified as poor and exempt from paying income tax. Middle-income earners will pay less than before, while the wealthiest Nigerians will contribute slightly more.

Political Opposition Raises Concerns

Former Labour Party presidential candidate Peter Obi described the situation as a shift “from padded budgets to forged laws,” arguing that discrepancies between the versions approved by the National Assembly and those gazetted by the executive go beyond clerical errors and threaten constitutional governance.

Obi warned that the alleged changes could undermine taxpayers’ rights and access to justice, citing provisions such as a mandatory 20% deposit before appeals and expanded enforcement powers as examples of alterations not approved by lawmakers. He also criticised the Presidency for failing to explain the discrepancies, calling for full transparency about what was passed, signed, and published — essential, he said, for maintaining public trust in the rule of law.

Similarly, former Vice President Atiku Abubakar accused the Federal Government of illegally altering the tax laws after parliamentary approval, describing it as a constitutional violation. He highlighted new enforcement powers allegedly inserted without legislative approval, including authority for tax agencies to carry out arrests or seize property without court orders.

Beyond political figures, many Nigerians have expressed confusion and concern about the new tax laws. A major source of anxiety has been the Tax Identification Number (Tax ID), with some fearing that everyone would need a separate Tax ID to access banking services or carry out everyday financial transactions. Others worried that the laws might allow automatic debits or freezing of bank accounts for non-compliance.

Some of the confusion has also centred on money received in personal bank accounts. Social media posts and online discussions suggested that any funds entering an account — including gifts from family or friends — could be taxed automatically.

Government Responds to Allegations

The Federal Government has rejected claims that Nigeria’s tax reform laws were altered after being passed by the National Assembly.

The Minister of Information and National Orientation, Mohammed Idris, said the executive branch is aware of only one version of the legislation — the copy transmitted by lawmakers and subsequently signed into law by President Bola Tinubu. He dismissed suggestions that multiple or conflicting versions exist, describing reports of discrepancies as misleading.

Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, described versions circulating in the media as inaccurate and urged Nigerians to await the outcome of the National Assembly’s investigation, noting that only lawmakers are in a position to clarify what was actually passed.

Authorities also addressed public concerns about the Tax ID. For individuals, the National Identification Number (NIN) will serve as the Tax ID, while companies can use their Corporate Affairs Commission (CAC) registration numbers. Tax officials emphasised that there is no need to obtain a separate Tax ID card and that the requirement aligns with previous laws, designed to streamline compliance rather than create barriers to banking or commerce.

Similarly, fears of automatic debits or account freezing were dismissed as unfounded, with no provision in the law authorising such actions. Only income that falls under taxable categories, such as salaries, business profits, or dividends, will be affected.

Authorities have stressed that preparations for the January 2026 implementation of the new tax laws will continue as scheduled.

What Is Really at Stake

The dispute over Nigeria’s tax reforms is about more than revenue or tax rates. At its core, it touches on public confidence — in institutions, in procedure, and in the principle that laws passed by elected representatives should remain unchanged.

As implementation draws closer, pressure is mounting for authorities to provide clarity and restore trust. Tax experts Chukwuemeka Eze and Godwin Oyedokun argue that the solution lies in openness rather than political debate. They say the National Assembly should publish the harmonised versions of the tax laws, noting that in many countries citizens can access final legislative documents online. Without such transparency, speculation thrives, even where no wrongdoing has occurred.

Beyond technical concerns, there is a broader climate of mistrust. Some citizens question whether taxes collected under the new system will translate into visible improvements in services and infrastructure — reflecting long-standing anxieties about governance and accountability in Nigeria’s fiscal system.

By addressing these misconceptions, government authorities and tax committee leaders hope to reassure the public and ensure that the January 2026 rollout proceeds smoothly, with taxpayers fully understanding their obligations and rights.

As tax experts note, clarity would either confirm the allegations or put them to rest. Major reforms, they say, require not just good intentions but unquestioned legitimacy. Without it, even the most ambitious policies risk being slowed by doubt and mistrust.