Nigerian Breweries is seeking new investors to invest in the company through Commercial Paper issuance, in order to borrow N25 billion.

The Commercial Paper issuance is in Series 4, 5 and 6, which were opened on 28 April 2023, and slated to close on 3 May 2023, a statement released on Tuesday, 2 May, disclosed.

Join our WhatsApp ChannelAccording to the brewer, the N25 billion will be raised from existing and new investors, who have to pay at least N5 million to access the Commercial Paper.

Nigerian Breweries said the Commercial Paper is an opportunity for new investors to invest in the non-alcoholic and alcoholic business, as well as for existing investors to increase their investment in the brewer.

The firm explained that the N25 billion will be utilised to support the short-term working capital and funding needs of Nigerian Breweries.

In the statement signed by Nigerian Breweries’ Company Secretary, Uaboi Agbebaku, the company said: “Nigerian Breweries Plc (“the Company”) is pleased to inform the investing public of the continuation of its Commercial Paper (“CP”) Programme with the launch of Series 4, 5 and 6 of the CP Programme that opened on 28th April 2023 and closes on 3rd May 2023.

“Series 4 is for a tenor of 95 days (with an implied yield of 12.5%), Series 5 for 186 days (with an implied yield of 13%), and Series 6 for 228 days (with an implied yield of 14%). The minimum subscription is N5m and multiples of N1,000 thereafter.

“The Company aims to raise up to about N25 billion to support the Company’s short-term working capital and funding needs under these Series.

“The CP Programme continues to provide an additional opportunity for existing and new investors to invest in the Company as well as support the Company’s cost management initiatives and serve as an additional source of funding for the Company.”

This fundraising will increase the company’s current liabilities which were N458.18 billion as of 31 December 2022. Already the current liabilities are above Nigerian Breweries’ current assets put at N186.04 billion.

Nigerian Breweries is going through a financial downturn, suffering N10.71 billion loss in the first three months of 2023, which has forced the company to depend on credit to keep operations running.

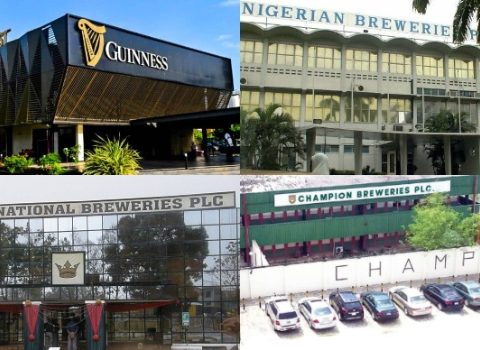

Nigerian Breweries is the producer of Star, Gulder, Goldberg and many other household brands.