Nigeria is pursuing a $1.5 billion aid package from the World Bank to address the severe dollar shortage, contributing to the decline of the naira.

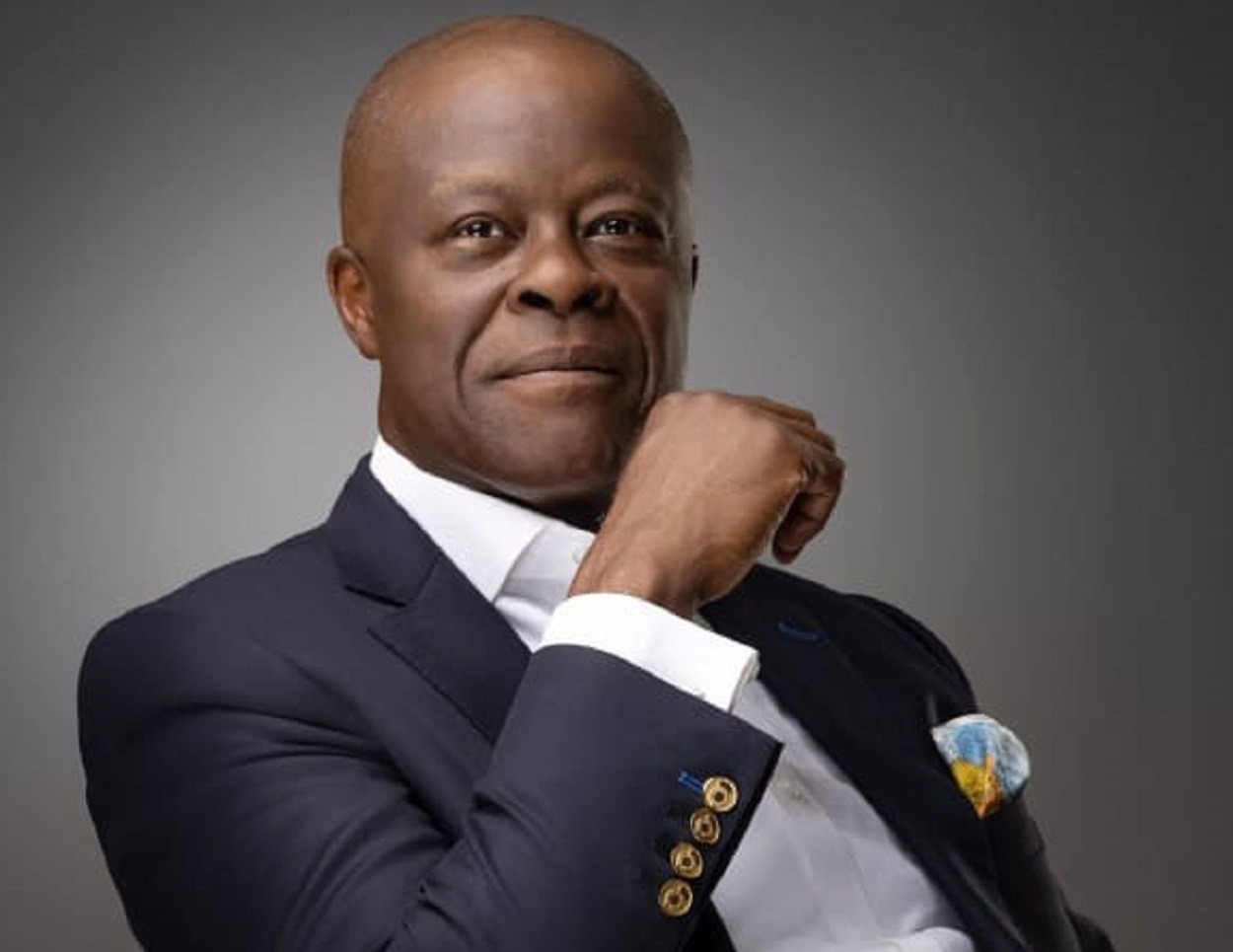

Finance Minister Wale Edun, in an interview with Bloomberg, stated, “We’re hoping to get $1 billion or $1.5 billion from the World Bank for budgetary support.” Edun highlighted ongoing economic reforms, expressing confidence that the country deserves international support.

Join our WhatsApp ChannelThe minister also revealed plans for a potential Eurobond issuance in late 2024, emphasizing its role as a mechanism to navigate challenging economic conditions. During discussions, Edun remarked, “It is a matter of discussion at the moment, but we think we will get the support because we are continuing with our reforms.”

Nigeria, with a history of Eurobond issuances, sees this avenue as crucial for funding infrastructure and boosting its economy.

The country had previously entered international debt markets with a $1.25 billion Eurobond issuance in 2022, marking its eighth venture into this financial arena.

In a press conference during the World Bank/IMF Annual meeting in 2023, Edun disclosed that the proposed $1.5 billion World Bank loan would carry zero interest, aimed at financing development.

Despite Nigeria’s existing debt challenges, with approximately N87 trillion, the minister assured that the loan would be used responsibly for development, with disbursement expected soon.

However, Nigeria’s economic landscape faces additional challenges, including a budget deficit in the 2024 fiscal year.

President Bola Tinubu highlighted a multifaceted financing approach, involving new borrowings, privatisation proceeds, and drawdowns on multilateral and bilateral loans.

As the naira grapples with persistent dollar shortages, increased demand, and speculative activities, its street value continues to be impacted.

On Wednesday, the naira hit a record low of N1,320 per dollar on the parallel market, reflecting a 4.72% depreciation, further emphasizing the urgency of addressing the economic challenges at hand.