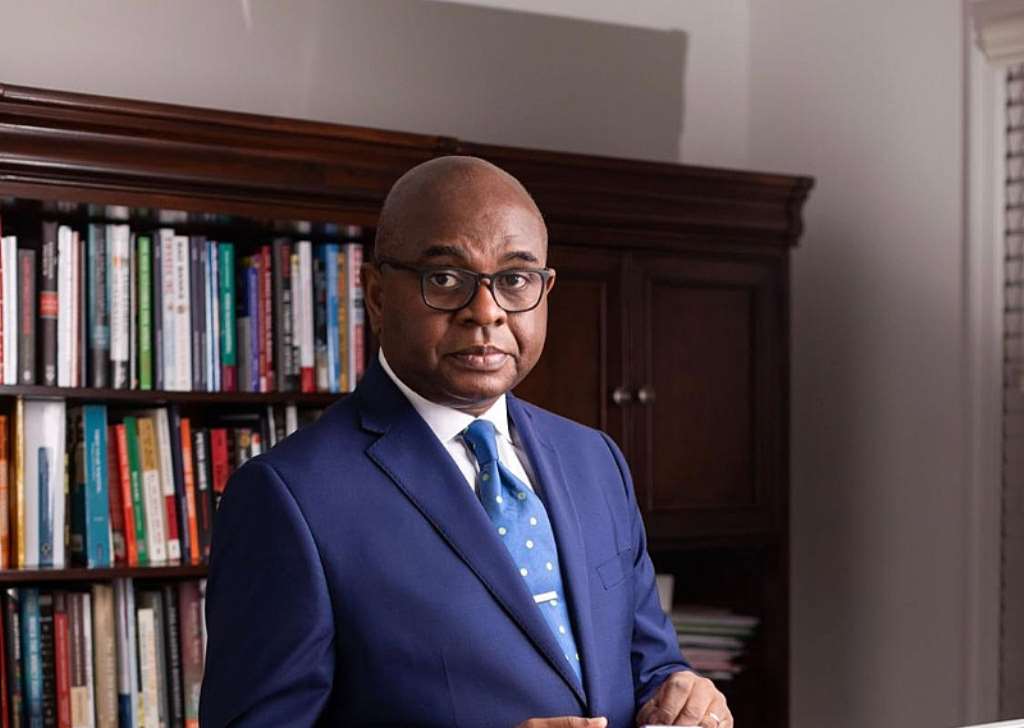

The former Deputy Governor of the Central Bank of Nigeria (CBN), Kingsley Moghalu, has warned the financial regulator not to criminalise cash transactions in Nigeria.

Moghalu, in a post on his Twitter page on Thursday, 23 March 2023, said the purpose of the cashless policy was not to criminalise the usage of cash but to encourage people to also adopt other digital forms of transaction.

Join our WhatsApp ChannelThe former Presidential aspirant said he is against any public policy that intends to make Nigeria a completely cashless society.

According to him, both cash and digital forms of payment can operate simultaneously, as even the most advanced societies are still dealing with cash.

He said Nigeria doesn’t have the necessary infrastructure to support its cashless society, coupled with the fact that the country’s rural and urban low-income market are cash driven.

Moghalu explained that forcing the cashless policy on Nigerians without adequate broadband and other infrastructure leads to human suffering and paralyses the economy which Nigeria is currently experiencing.

“When we as the Committee of Governors @cenbank introduced the “cash-less” policy a decade ago, the purpose was to encourage digital and electronic payments for increased efficiency, but NOT to criminalize cash or abolish cash transactions for those who CHOOSE to use that method.

“I strongly disagree with any public policy direction that seeks to render Nigeria a completely “cashless” society. Even in the more advanced industrial countries, cash is still very much used. Why do we think we can leapfrog into being holier than the pope when we don’t have the essential broadband and other infrastructure, and when we have a rural and urbane low income economy that is mostly cash based

“The result is the human suffering /economic paralysis we are witnessing in Nigeria today. We should beware of “fads” out of touch with our environment,” Moghalu wrote.

His statement followed the decision of the central bank under Godwin Emefiele to reduce the volume of cash in the economy by phasing out old Naira notes of N200, N500 and N1,000, in order to force Nigerians into using the digital platform.

However, the infrastructure of banks was not able to meet demands for the digital transaction after the phasing out, as many commercial banks’ mobile apps record transaction failure, leading to public outcry and criticism against Emefiele and the CBN, that the financial regulator and the banks were not ready for the policy they embarked on.