Economic reports from the Manufacturers Association of Nigeria (MAN) reveal a downturn in investments within Nigeria’s manufacturing sector, plummeting by N367.79 billion between 2014 and 2022.

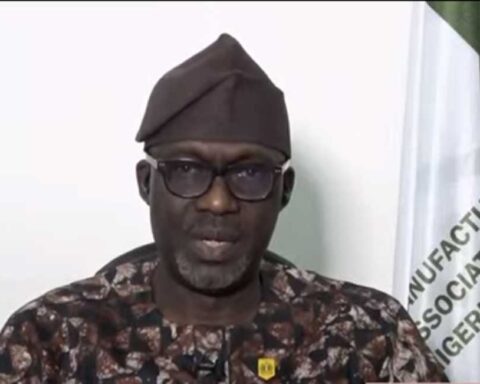

Muda Yusuf, CEO of the Centre for the Promotion of Private Enterprise, highlighted persisting challenges as the key factor behind this decline. He emphasized the sector’s vulnerability to issues like high energy costs and heavy dependence on imports, especially for raw materials, severely impacting operational expenses.

Join our WhatsApp ChannelAccording to Yusuf, “The reasons for the decline are obvious. The challenges in manufacturing have been quite enormous over the last few years.”

READ ALSO: Manufacturing Sector Witnesses Soaring Capital Inflow In H1

The data collected from various reports underscores a bleak picture: in 2014, the sector witnessed an injection of N691.7 billion in investments.

However, this positive trend nosedived, with investments reaching a disheartening low of N118.5 billion in 2020 due to the disruptions caused by the COVID-19 pandemic. Despite a partial resurgence in the subsequent years, the cumulative drop in investment stands at a stark 53.3 percent.

Furthermore, MAN’s analysis pointed out that the high debt profile of the government discourages foreign investment, coupled with elevated borrowing costs, energy expenses, and reduced demand, all contributed significantly to this downturn.

The association also highlighted a positive uptick in the sector, with investments escalating to N305.02 billion and N323.98 billion in 2021 and 2022, respectively.

However, this increase is in reality, a nominal one caused primarily by the currency devaluation, reflecting a higher nominal value due to the devalued naira rather than an actual surge in physical investments.

Amidst concerns over potential job losses and looming factory shutdowns, Yusuf stressed the urgency of targeted policy interventions to reignite investor interest and reverse the alarming trend witnessed in Nigeria’s manufacturing landscape.

“The second major issue is the issue of forex. Most manufacturing firms are heavily import-dependent, especially for raw materials. With the current nature of the economy, any business that is import-dependent will be vulnerable.”

Emmanuel Ochayi is a journalist. He is a graduate of the University of Lagos, School of first choice and the nations pride. Emmanuel is keen on exploring writing angles in different areas, including Business, climate change, politics, Education, and others.