Three major cement companies in Nigeria – Dangote Cement, Lafarge Africa and BUA Cement- failed to grow their net profit in Q3 2022, despite hike in revenue generated for the period.

Prime Business Africa’s industry review shows that Nigerians spent about N526.52 billion in three months, up from the N468.44 billion the companies generated from cement sales between July and September 2021.

Join our WhatsApp ChannelWhile cement revenue rose 12.39%, the cost of producing the product in Q3 2022 was N251.35 billion, surpassing the N205.36 billion cost of production for the same period last year.

READ ALSO: BUA Pulls Out Of Kogi Over Land Crisis, Govt Threats

This means the cost of producing the cement sold by the three companies grew by 22.34%, surpassing the 12.39% growth recorded in the earnings.

As a result, the combined net profit of Dangote, Lafarge and BUA fell by -49.55% to N61.13 billion in the third quarter this year, falling short by N60.06 billion when compared to the N121.20 billion grossed in Q3 2021.

READ ALSO: Stock Roundup: BUA Cement Leads Gainers, Dangote Cement Joins Losers’ List

Breakdown of companies by performance

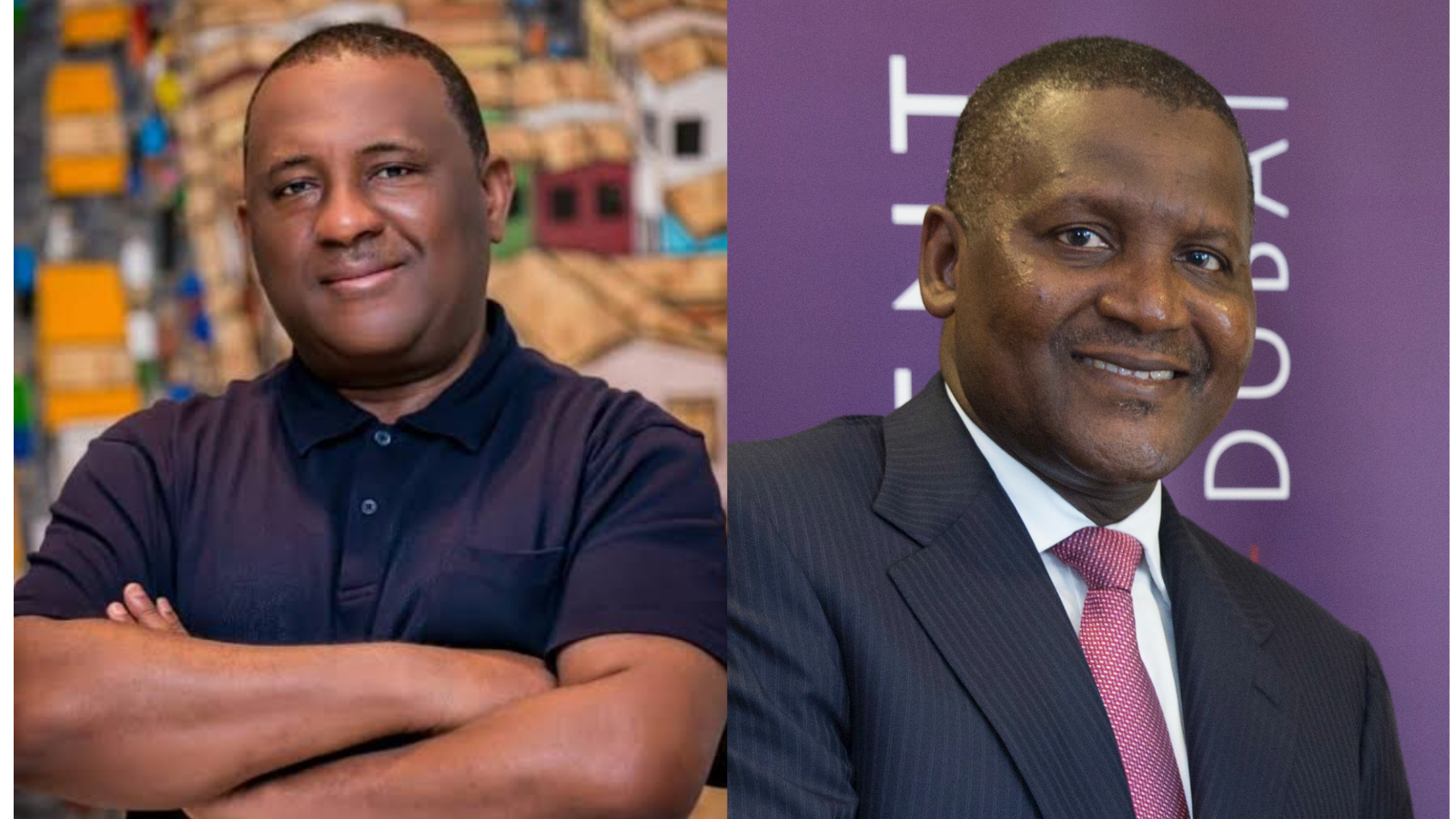

The list is compiled by best performance based on revenue growth of Dangote Cement, Lafarge Africa and BUA Cement.

BUA

BUA grew its revenue by 18.21% year-on-year, the highest growth among the major cement producers, to close the period with N74.03 billion, surpassing the N62.62 billion generated in Q3 last year.

However, the management was unable to stop the expenses on production, as it increased to N45.32 billion in Q3 2022, which is N11.82 billion more than the N33.49 billion spent last year’s period.

This impacted the company’s net profit that dropped by -43.79%, representing a loss of N9.85 billion, considering its profit after tax for Q3 last year was N22.51 billion, but it recorded N12.65 billion PAT same period this year.

The foreign owned cement company generated N83.26 billion between July to September 2022, which is 12.24% higher than the N74.18 billion grossed in Q3 last year.

Lafarge Africa was the only company among the major manufacturers to reduce its cost of sales, which dropped by -0.06% to N44.56 billion, slightly below the N44.59 billion spent to produce the cements in the period ended September 2021.

In spite of that, the company was unable to prevent its net profit from declining by N4.58 billion, when the N12.07 billion grossed in Q3 2021 is compared to the N7.48 billion reported as PAT same period of 2022.

Dangote

The Aliko Dangote-owned company recorded the lowest turnover growth of 10.17% after closing the third quarter with N369.21 billion. This is more than the N331.64 billion generated in Q3 2021.

During the period, Dangote saw its production cost rise to N161.37 billion, a difference of 26.79% when compared to the N127.27 billion expanded on producing its cement Q3 last year.

Similarly, the profit after tax of Dangote Cement fell, down by -52.67%, from the N86.62 billion reported as net profit for third quarter 2021, to N40.99 billion posted this year Q3.