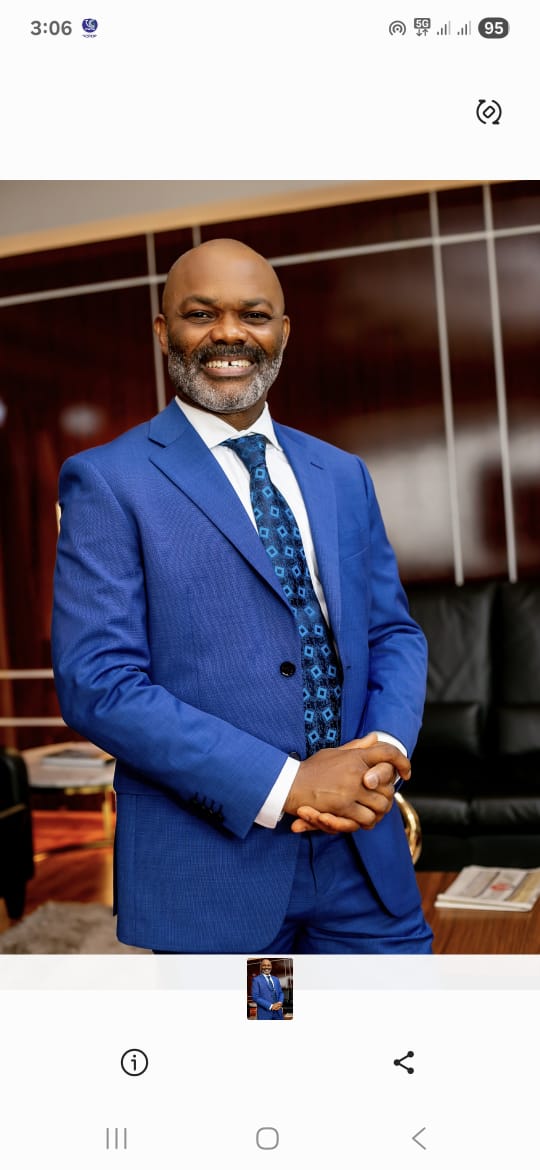

In an era where borders are becoming increasingly thinned out, and wealth knows no bounds, Optiva Capital Partners is emerging as a trailblazer in Africa’s investment immigration landscape. At a recent media interactive session, FRANKLIN NECHI, Chairman of Optiva Capital Partners, sat down with senior journalists to share the company’s inspiring story, its strategic partnerships, and its bold vision for the future of global wealth retention and investment immigration. Nechi reveals how Optiva Capital Partners is redefining the concept of mobility and opportunity, and why Africa is poised to become the next big frontier in global investment immigration.

Read the full text of the interview below:

Optiva Capital Partners has been widely described as Africa’s leader in investment immigration. What does leadership in this field mean to you, and how has Optiva earned that position?

Leadership in investment immigration goes beyond market share or brand visibility. To me, it means setting the standard — ethically, professionally, and impactfully — for how African families can build global access and financial freedom through legitimate, compliant channels. Optiva earned this leadership through three things:

Integrity in execution — we are 100% transparent with clients and program partners.

Expertise and structure — our advisory model integrates immigration, wealth retention, and global investment advisory under one roof.

Impact at scale — We have helped thousands of African families secure second citizenships, educational opportunities for their children, and access to global healthcare and business ecosystems.

READ ALSO: Innovation Series: Michael Gelpke Brings Home a Governmental Contract Worth 160M USD In Africa

Our leadership is not claimed; it is earned daily through trust, compliance, and tangible transformation.

What was the original vision behind Optiva, and how has it evolved over the years?

When we started Optiva, our vision was clear — to help African families access global opportunities that were once the preserve of a few. We wanted to break the myth that global mobility and wealth preservation were “foreign” privileges.

Over time, the vision evolved from “immigration investment” to “lifestyle and generational wealth solutions.” Today, we don’t just help clients get passports; we help them build legacies — with global investments, education planning, wealth diversification, and estate management. We’ve become the trusted bridge between African aspiration and global opportunity.

In practical terms, how has Optiva transformed the lives of its clients across Africa?

The stories are endless — and deeply personal. We’ve seen:

Families who once struggled with visa restrictions now travelling freely for business or medical treatment.

Parents whose children now study in top global universities under citizenship-by-investment programs.

Entrepreneurs who diversified their wealth into stable economies, protecting their assets from currency volatility.

Beyond the numbers, the transformation is psychological and generational — clients now see themselves as global citizens with the freedom to live, invest, and retire anywhere in the world.

That’s real transformation — financial empowerment and global dignity.

Optiva is recognized for its strong global partnerships. What do these partnerships look like, and how do they give you an edge?

Our partnerships are not just business arrangements; they are strategic alliances built on mutual credibility and shared values.

We work directly with governments, investment agencies, real estate developers, and licensed program administrators across Europe, the Caribbean, North America, and the Middle East. This gives Optiva three major advantages:

Access — first-hand information and early access to new investment immigration programs.

Speed and assurance — we process client applications with the confidence that comes from direct governmental relationships.

Diversification — our clients benefit from a global menu of options, from Caribbean citizenships to European residency and real estate investments in Dubai.

These partnerships are the backbone of our leadership — and they’re built on years of trust and professionalism

How do you ensure credibility and compliance when dealing with foreign governments and program administrators?

Compliance is non-negotiable. Optiva operates with the same due diligence standards as any top global financial institution.

READ ALSO:NECHI: Optiva Capital’s Edge Is Our Exclusive Partnerships With Reputable Global Institutions

NDLEA Inducts Optiva Capital Partners’ Franklin Nechi As WADA Ambassador

Optiva Capital Partners Reaffirms Leadership in Africa’s Investment Immigration Industry

We maintain a robust compliance framework:

Know Your Customers and Anti-Money Laundering procedures aligned with international best practices.

Collaboration only with licensed program promoters and government-approved channels.

Constant staff training on global regulatory standards.

We believe credibility is not built through advertising — it’s built through discipline, documentation, and transparency.

In a space where trust is critical, how does Optiva maintain its reputation for integrity and transparency?

Trust is our strongest currency. We protect it jealously.

Every Optiva client knows exactly what they’re paying for, what’s legally required, and what’s possible — no hidden clauses, no inflated promises.

We maintain an open-door policy for both clients and regulators. Internally, we foster a culture of ethical leadership — every team member understands that one misrepresentation can cost years of credibility.

In short, we don’t just sell programs — we sell peace of mind.

Optiva recently made a foray into real estate investments in Dubai. What was the thinking behind this expansion?

Our expansion into Dubai real estate was both strategic and visionary. Dubai represents a global investment hub where African investors can participate safely and profitably.

We noticed many of our clients wanted not just residency or citizenship, but solid asset-backed investments in stable markets. Real estate in Dubai offers that — strong capital appreciation, rental income, and global prestige.

It’s a natural extension of what we do: helping Africans build wealth and identity without borders.

How do real estate opportunities complement investment immigration solutions?

They go hand-in-hand. Many immigration programs today — from Portugal to the UAE to the Caribbean — are property-linked.

By combining both, we create an integrated wealth pathway:

You secure a global home (real estate),

You gain residency or citizenship rights, and

You diversify your wealth internationally.

It’s about moving from “migration of people” to “migration of prosperity.”

What kind of real estate opportunities in Dubai are most attractive to African investors today?

African investors are drawn to mid-luxury and off-plan developments — properties that combine affordability, high yield, and long-term appreciation.

We focus on strategic areas like Business Bay, Downtown Dubai, and Dubai Creek Harbour. These are locations with liquidity, rental demand, and future upside.

Optiva also works directly with top-tier developers — ensuring our clients buy into credibility, not speculation.

For us, it’s not just selling property — it’s curating safe and profitable global assets for our clients.

How is demand for investment immigration changing in Africa, and what trends do you see shaping the future?

The demand is accelerating — and evolving. Five years ago, most clients wanted “Plan B” passports for travel convenience. Today, the motivation has expanded to include education planning, asset diversification, and global entrepreneurship.

The trend is toward structured, wealth-driven mobility — Africans are no longer seeking escape; they’re seeking expansion.

In the future, I see Africa becoming a net participant in global capital and citizenship — not just a beneficiary. And Optiva will remain at the forefront of that transformation.

What message would you give to Africans who see second passports as something “out of reach” or only for the elite?

That mindset is changing — and we are proud to be part of that change. A second passport is no longer a luxury; it’s a strategic tool for personal and financial growth. Through our flexible plans, structured payment options, and advisory guidance, Optiva has democratized access to global citizenship.

My message is simple: Don’t think of it as a passport; think of it as a platform — for your children, your business, and your freedom.

Finally, what is your long-term vision for Optiva Capital Partners and its role in Africa’s global integration?

Our long-term vision is to make Optiva the continent’s leading platform for global wealth mobility.

We want every African family with ambition to find a trusted partner in Optiva — for citizenship, for investment, for financial planning, and for legacy creation.

We see ourselves as part of Africa’s rebranding story: from aid recipients to global investors.

Optiva will continue to lead that narrative — with professionalism, credibility, and heart. We are not just selling passports; we are helping Africans own a stake in the global future.

- Editor

- Editor

- Editor

- Editor

- Editor