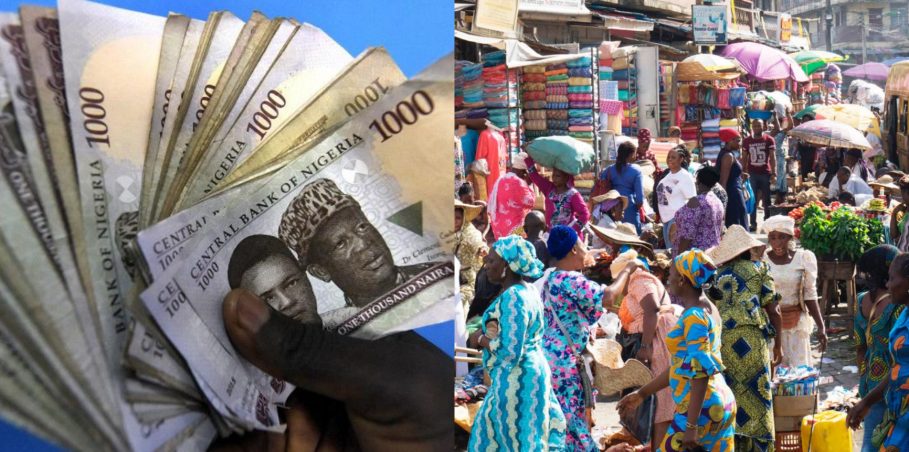

Last week, the Nigerian equity market took a downturn, shedding N1.57tn in value. Analysts attribute this decline to various factors, including prevailing market dynamics and changes in fundamentals amid a high-interest rate environment and mixed macroeconomic data.

The All-Share Index closed at 99,539.75 points, marking a 2.71% decrease, while market capitalization ended at N56.296tn.

Join our WhatsApp ChannelSell-offs, particularly in banking stocks due to the Central Bank of Nigeria’s recapitalization drive, drove the market losses. Investors traded 1.6 billion shares valued at N32.31bn in 44,915 deals, with the financial services industry leading the activity chart.

Banking stocks dominated the top three equities with the highest activities, including Access Holdings Plc, United Bank for Africa Plc, and Zenith Bank Plc. These three accounted for a significant portion of the total equity turnover volume and value.

READ ALSO: Volatile Week As Equity Market Sheds N623bn In Value

The banking index led the losses, dropping by 11.46% week on week. Other sectors also experienced declines, including insurance (2.80%), industrial goods (2.71%), and consumer goods (0.96%). However, Sovereign Bond appreciated by 3.57%, while the ASeM and Oil and gas indices closed flat.

Among the best-performing stocks were Morison Industries, Guinness Nigeria, and Academy Press, while decliners included GTCO, Unity Bank, and Livestock Feeds.

During the week, Fidelity Bank and Industrial & Medical Gases Nigeria announced dividends for shareholders, providing some positive news amid the market downturn.

Looking ahead, analysts project a continued pullback as investors monitor earnings numbers, macroeconomic data, and government policies for guidance.

“We think investors will closely monitor expected earnings numbers, published macroeconomic data and government policy direction for further guidance,” the Cowry Research weekly market report said.

Emmanuel Ochayi is a journalist. He is a graduate of the University of Lagos, School of first choice and the nations pride. Emmanuel is keen on exploring writing angles in different areas, including Business, climate change, politics, Education, and others.