Bureau De Change operators and commercial banks have been warned by Economic and Financial Crimes Commission (EFCC) ahead of the release of the redesigned naira notes in December.

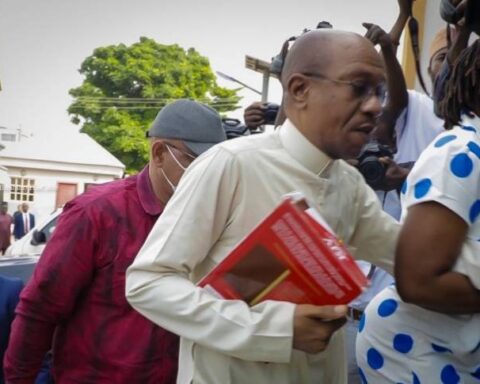

The Executive Chairman of EFCC, Abdulrasheed Bawa, said financial institutions should be careful at this period, as persons with illicit funds in naira will try to do-away with the money they hoarded.

Join our WhatsApp ChannelHis statement comes after the Governor of the Central Bank of Nigeria (CBN) announced that redesigned naira notes of N200, N500 and N1000 will be released on December 15, 2022.

With the decision, it is believed that persons with illegal money will try to exchange it for the new currency, so Bawa urged banks to enforce their obligation of reporting illegitimate transactions.

He said the new currency will help with monetary policy, as, “The EFCC, the CBN and some other regulators in the financial sector have worked closely in the recent past to determine how best to stabilize the country’s monetary policy environment.

“It is heart-warming that the CBN has demonstrated courage in taking this bold decision which I believe will bring sanity to the currency management situation in Nigeria.”

Recall that Prime Business Africa had reported that about N600 billion was in the vaults of Nigerian banks, out of the N3.3 trillion notes in circulation, indicating that N2.7 trillion was not in the financial system.

With expectations that individuals hoarding the naira notes will find a way to exchange for the new currency, Bawa said the decision by the CBN is in line with EFCC’s money laundering.

“According to Section 2 (1) of the Money Laundering Act 2022 “No person or body corporate shall, except in a transaction through a financial institution, make or accept cash payment of a sum exceeding— (a) N5,000,000 or its equivalent, in the case of an individual ; or (b) N10,000,000 or its equivalent, in the case of a body corporate.” Bawa said.