The present economic challenges are undoubtedly harsh, but great efforts are being made by both the fiscal and monetary authorities to arrest the situation and stabilize the economy.

Worldwide, economies go through cycles of expansion, peak, contraction, inflation and trough, arising from different variables either internal or external or both.

Japan faced stagnant growth throughout the 21st century and toyed with different policy options towards stabilising the economy. Germany had witnessed hyperinflation in the distant past, and Zimbabwe too, in the 2000s.

America had once faced the biggest economic recession with the economy almost on the brink of collapse. Also in 2008-09, the US economy witnessed another cycle during the global financial meltdown which was triggered by the subprime crisis.

The US economy has also witnessed debilitating inflationary pressure at different times.

Inflation is a spoiler, a thief of value, which hurts citizens’ buying power and makes it difficult for people to afford basic necessities of life. It also discourages savings and investments and can destabilise the economy.

Central banks prioritise the fight against inflation and would readily trade off growth until inflation is arrested.

That is what the Central Bank of Nigeria ( CBN) is doing and which is rational. Tackling inflation is a top priority for CBN and the Bank is working with coordinated policy measures to tame inflation.

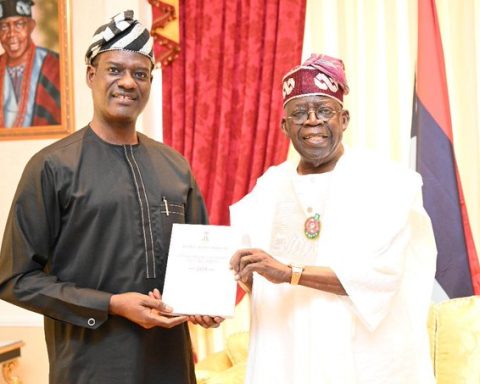

CBN Governor, Olayemi Cardoso, had assured that the Bank would not shirk in its duties and that they were working hard to find solutions and promised that they would not betray trust.

Resulting from CBN’s coordinated policy measures, the National Bureau of Statistics (NBS) reported that headline inflation in 13 states slowed down for three consecutive months.

Month-on-month inflation rate decreased to 2.14 per cent in May, from 2.9 per cent in April and 3.02 per cent in March 2024. However, year on year inflation continued to rise and stands at 34.2 per cent.

In accordance with the principle of monetarism, CBN has consistently hiked the Monetary Policy Rate (MPR) to fight inflation.

But the Lagos Chamber of Commerce and Industry (LCCI) suggested that CBN’s efforts should be complemented with additional fiscal measures that aim to boost the supply side of the economy.

LCCI suggested the improvement of agricultural productivity and increasing capital expenditure to support business activities and growth. It noted that the government had released N1.84 trillion at mid-year, out of N12.2 trillion capital expenditure component and should release more.

Former CBN Governor, Professor Kingsley Moghalu had commended CBN’s efforts, though he also said that the policy measures would hit businesses hard. However, he noted that because inflation was hitting hard, it needed to be controlled.

Nwobu, a Chartered Stockbroker and Business Journalist, can be contacted via arizenwobu@yahoo.com Tel: 08033021230