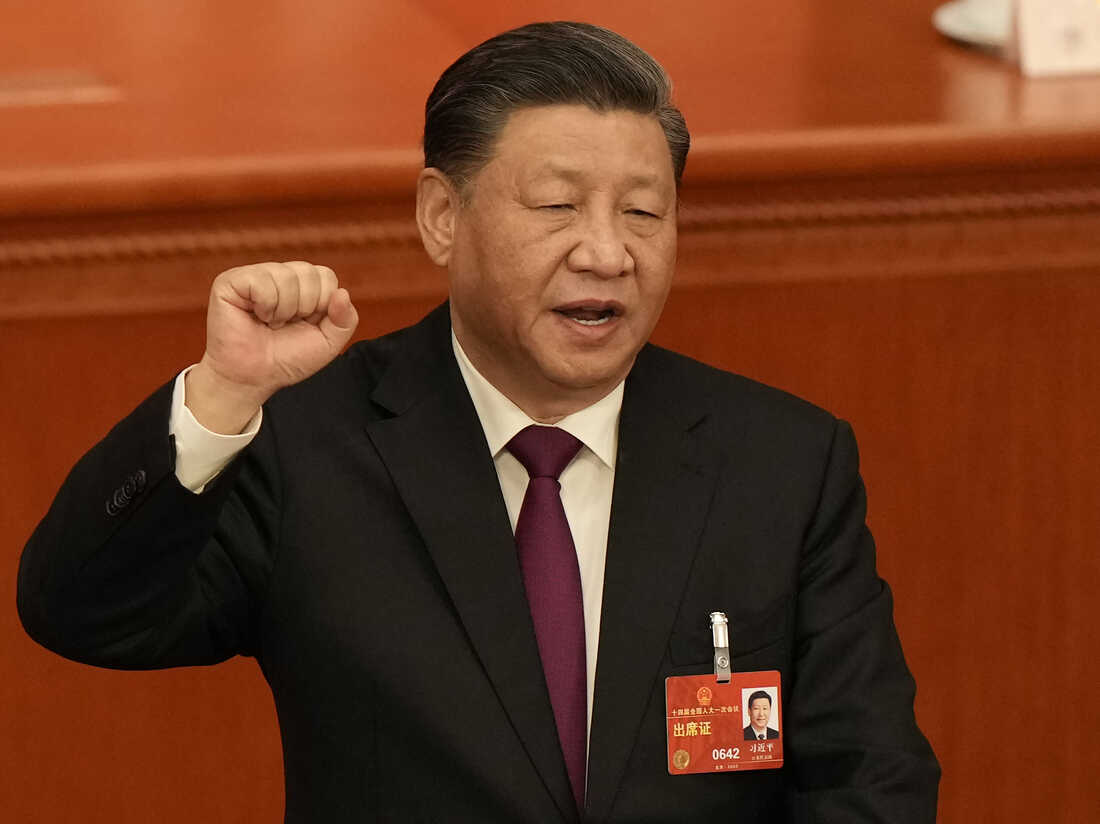

China’s booming exports have handed Beijing critical leverage as President Xi Jinping and US President Donald Trump lock into the fiercest trade confrontation in years, warns global financial advisory giant deVere Group.

Join our WhatsApp Channel

China’s exports jumped 8.3% in September from a year earlier, smashing forecasts and outpacing August’s growth.

Imports climbed 7.4%, a signal that the country’s industrial engine remains formidable despite Washington’s efforts to apply pressure through tariffs and technology restrictions.

The surge lands as US Treasury Secretary Scott Bessent hints that the current three-month pause on import duties could be extended — but only if China abandons its plan to impose strict new export controls on rare-earth elements.

These materials are indispensable for global manufacturing, from electric vehicles to advanced chips and weapons systems.

Nigel Green, CEO of deVere Group, says: “Scott Bessent is trying to use tariff relief as leverage, but Beijing’s export rebound means the pressure is flowing both ways.

“Xi Jinping now has proof that China’s trade engine is resilient and that his government can absorb external shocks while the US is still searching for negotiating traction.”

The standoff has escalated since Beijing announced sweeping export licences for rare-earth and magnet technologies, effectively tightening its grip over supply chains that the West cannot yet replace.

Washington’s reaction was immediate: threats of 100% tariffs, new curbs on Chinese software, and talk of allied coordination through the G7 to deter further Chinese restrictions.

“The trade war has evolved into a power contest over who controls the materials and technologies that drive the modern economy,” says Nigel Green.

“China’s message is that it can dictate the pace of global production. Washington’s message is that it’s willing to risk economic pain to prevent that dominance.

“Neither side looks ready to blink.”

China: The World’s Tallest Bridge is 21st-Century Engineering Marvel in Guizhou

Nigeria Seeks $2bn China Loan to Build National Super Grid – Adelabu

Despite the stand-off, China’s export growth is being driven by markets far beyond the US. Shipments to the European Union, Southeast Asia, Africa, and Latin America are all rising at double-digit rates, showing how effectively Beijing has diversified its trade routes.

Exports to the US, by contrast, continue to shrink sharply, down more than a quarter year on year, yet China’s overall export growth remains robust.

Nigel Green says: “Beijing’s ability to expand into new markets while withstanding US tariffs is one of the defining shifts of the decade.

“It shows how global manufacturing still relies on China’s capacity, logistics, and pricing power. Even in a period of confrontation, the rest of the world cannot easily step away.”

Markets are already feeling the tension. Currency volatility has increased, commodity prices have jumped, and equity investors are recalibrating exposure to sectors tied to global manufacturing.

“The next phase of this trade battle will shape monetary policy and investor sentiment worldwide,” says the deVere CEO.

“If tariffs rise and supply chains fracture, inflationary pressures could return just as central banks are preparing to loosen policy. The combination could create both disruption and opportunity across portfolios.”

He adds: “Periods of geopolitical stress often produce outsized gains for those positioned ahead of the cycle.

“Countries and companies able to fill the production gaps left by restricted trade will emerge as major winners.

“Investors who maintain diversified exposure across regions and asset classes will be best placed to benefit.”

For now, Beijing appears emboldened. The export data bolster its claim that China can weather any tariff escalation and sustain global demand. Washington, meanwhile, faces the dilemma of tightening further without triggering inflation or alienating allies who depend on Chinese supply chains.

Nigel Green concludes: “The numbers out of Beijing change the tone of the talks. China goes into the next round stronger, not weaker.

“The US may hold the world’s largest consumer market, but China is proving it still controls the world’s factory floor.”

- Editor

- Editor

- Editor

- Editor

- Editor