The Central Bank of Nigeria has announced a review of its restrictions on cryptocurrency transactions in the country.

The apex bank in a circular dated December 22, 2023, with reference number FPR/DIR/PUB/CIR/002/003, and signed by the Director, Financial Policy and Regulation Department, Haruna Mustafa, said that given current trends globally it has come to realise the need for a review of its crypto regulation hence changing its earlier position on crypto assets.

Join our WhatsApp ChannelREAD ALSO: CBN Fines Union Bank N200 million For Cryptocurrency Trading

According to the circular tagged ‘Circular to all Banks and other Financial Institutions Guidelines on Operations of Bank Accounts for Virtual Assets Service Providers (VASPs),’ the new guidelines allow virtual assets service providers (VASPs), to operate accounts with banks and other financial organisations.

The circular, however, indicated that banks and other financial institutions were still not allowed to hold, trade and/or transact in virtual currencies on their own accounts.

The CBN had in February 2021 issued an order restricting banks and other financial institutions from operating accounts for cryptocurrency service providers in view of the money laundering and terrorism financing (ML/TF) risks and vulnerabilities inherent in their operations and also the absence of regulations and consumer protection measures.

“However, current trends globally have shown that there is need to regulate Virtual Assets Service Providers (V/ASPs) which activities of virtual assets service cryptocurrencies and crypto assets. Following this development, the Financial Action Task Force (FATF) in 2018 also updated its Recommendation 15 to require VASPs to be regulated to prevent misuse of virtual assets for ML/TF/PF Furthermore, Section 30 of the Money Laundering (Prevention and Prohibition) Act, 2022 recognizes VASPs as part of the definition of a financial institution,” the statement said.

“In addition, the Securities and Exchange Commission in May 2022 issued Rules on Issuance, Offering and Custody of Digital Assets and VASPs to provide a regulatory framework for their operations in Nigeria.

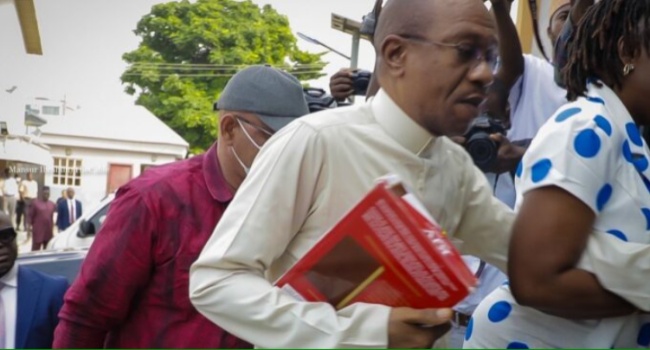

READ ALSO: CBN Investigator’s Report Reveals How Emefiele, Others Stashed billions In 593 Accounts

“In view of the foregoing, the CBN hereby issues this guideline to provide guidance to financial institutions under its regulatory purview in respect of their banking relationship with VASPs in Nigeria.”

While this is not a full scale suspension of the ban on cryptocurrency transactions in the nation’s financial institutions, analysts and crypto enthusiasts believe it’s a sign of good days ahead.