The Minister of Finance, Zainab Ahmed, and the President of the Africa Development Bank (AfDB), Akinwumi Adesina, both disagreed over Nigeria’s debt situation.

Both Ahmed and Adesina spoke about Nigeria’s over N42 trillion debt at the Nigeria International Economic Partnership Forum in New York, with the former saying Nigeria has revenue problem, but the latter argued that it’s debt problem.

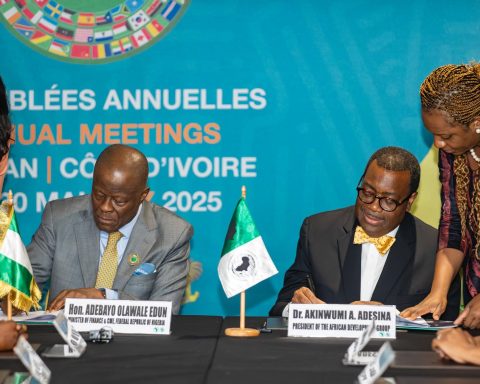

Join our WhatsApp ChannelAdesina had said Nigeria needs help with its debt situation, stating, “Nigeria’s total debt level is N42.84 trillion or $103 billion. External debt levels stand at N16.61 trillion or $40 billion. Ladies and gentlemen, Nigeria needs help to tackle this debt burden.”

He added that, “Nigeria and other African countries, in my view, therefore need debt relief. They cannot run up the hill carrying a backpack full of sand.”

However, Ahmed disagreed, saying the problem is revenue generation, not debt as said by many, including Adesina, “Everywhere we go, we hear this issue of the debt of Nigeria is a problem and is not sustainable. The debt and debt financing that we do in Nigeria is following a designed debt management strategy,” she said.

“As of today, and this has been reported by two previous speakers, Nigeria’s public debt stock is $100.1 billion or N14.6 trillion, which represents 24 percent of the nominal GDP. This is below the 40% threshold that we have set up for ourselves.

“Nigeria operates a four year rolling medium term strategy which guides the borrowing strategy of the federal government. And we have specific indices that we closely monitor. The public debt that we set is 40 percent and we are at 24 percent.”

She further explained that, “We do have a revenue problem and this revenue problem, we’re tackling using the instrument of the strategic revenue initiative, the revenue challenges we have we have been addressing in a systematic manner.

“We have had a very significant impact in revenue performance based on the issues in the oil sector, and it is being addressed by the security agencies.

“There are some ineffective tax incentives that are currently in process of being review, so some that have reached maturity will not be renewed, there might be some new ones that are being introduced, but we’re trying to make sure that we’re getting value for the investments that we have provided.” Ahmed said.